Reps React to Effects of Consolidation

Fewer and more powerful dealers means a reshaping of the landscape for manufacturer rep companies, as well as how they go to market.

Consolidation is a major force among dealers and manufacturers alike. The impact of mergers and acquisitions is not limited to those silos, though. Independent manufacturers’ representatives are among the companies most affected.

Stating the obvious: Dealer consolidation means fewer companies account for more sales. Strong relationships with these large dealers are now more important than ever.

Bumping up against this reality are reports from some (but not all) reps that dealer relationships have changed, especially compared to pre-COVID days. A leader with one rep firm, for instance, says the company previously had one to two standing meetings with each of the three biggest dealers in its region every week. Those meetings simply don’t happen today.

Jim Zink, managing partner at Columbus, Ohio-based Zink Foodservice, says his company has found it harder to set up traditional meetings with dealers in recent years. His solution: Each rep firm must prove to dealers that they’re worth meeting with.

“If you’re valuable, they will figure out a way to connect with you,” says Zink. “Are your people any good? Are your facilities any good? Do you have the right products that solve problems for customers? Are your salespeople prepared and professional? All those things boil down to this value proposition.”

Melissa Greenwald, president of Columbus, Ohio-based Greenwald Sales & Marketing (GSM), says her firm hasn’t had trouble accessing the dealers in its territories. The way it connects with these channel partners has changed, though. Instead of visiting dealers — a function that hasn’t fully recovered post-COVID-19 — more DSRs are coming to GSM. Greenwald’s firm now hosts regular events to educate dealer salespeople on its lines, usually with a sweetener like breakfast included, and “always delivering an elevated experience,” she says.

Nevertheless, some rep firms do find it harder to meet with certain dealers in their territories. This can have negative consequences in the long term. Fewer meetings may result in a drop in product knowledge among dealer sales reps, fewer chances to discuss opportunities and leads, and a drop-off in the overall relationship, says one rep executive.

Impact of Top 10 Distribution Giants

Other than a pandemic-year blip, the Top 10 dealers in FE&S Distribution Giants studies have grown their share of market every year for the past decade. This growth makes rep relationships with the top firms more important.

|

Year |

Distribution Giants |

Distribution Giants |

Top 10 |

|---|---|---|---|

|

2015 |

$4.53 |

$8.00 |

56.66% |

|

2016 |

$5.35 |

$9.02 |

59.35% |

|

2017 |

$6.08 |

$9.64 |

63.12% |

|

2018 |

$6.64 |

$10.30 |

64.49% |

|

2019 |

$7.24 |

$11.06 |

65.43% |

|

2020 |

$5.97 |

$9.40 |

63.49% |

|

2021 |

$7.82 |

$11.72 |

66.73% |

|

2022 |

$9.95 |

$14.51 |

68.56% |

|

2023 |

$10.68 |

$15.65 |

68.27% |

|

2024 |

$11.24 |

$15.74 |

71.40% |

Source: FE&S Distribution Giants studies

2 Discernable Rep Shifts Happening

- Dealer consolidation means fewer companies account for more sales.

- Strong relationships with large dealers are now more important than ever.

Rep Consolidation Follows Dealer Consolidation

Consolidation among manufacturers is an even bigger challenge for reps. Simply put, fewer factories mean fewer clients. Those reps that manage to land a conglomerate may have to agree to some level of exclusivity with that company.

Zink Foodservice works with a large conglomerate. Partnering with this company “is a privilege,” Zink says, but it does carry a risk. If a conglomerate decides to make a change, the rep firm on the outs could find itself in a very difficult financial position.

As a hedge, Zink has expanded his firm into new areas. “You’re only going to have so much control if you’re playing in one basket. So, how do you get some other baskets? That’s what we did.”

Indeed, a look at Zink Foodservice’s website shows how many baskets it now has. In addition to kitchen equipment manufacturers, the firm reps smallwares and tabletop items. It also has a furniture division covering the foodservice, lodging, hospitality and education markets. And it has its own ventilation line.

Similarly, Greenwald Sales & Marketing works to ensure a balanced line card from both a revenue and product-mix standpoint. In some cases, this might result in taking on a new product category.

“It’s not just adding a line, it’s adding a strategic category,” says Greenwald. “We’ve recently added furniture to our assortment, which allows us to grow in our front-of-house offerings and potentially insulates us from those things that are outside of our control.”

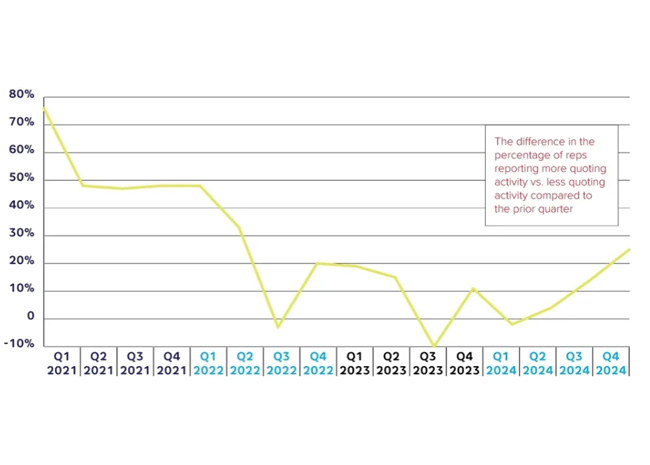

Post-Pandemic Quoting Activity Steadies

Following a post-pandemic spike, changes in rep quoting activity compared to the prior quarter have settled into a steadier range over the past two-plus years.

Source: MAFSI Business Barometer

Source: MAFSI Business Barometer

Manufacturer-Rep Relationship Shifts

Another shift reps are dealing with is simply the demands from factories for more. More sales, of course, but also more forward-looking reports on the sales pipeline along with more services, like test kitchens and corporate chefs.

These new demands should be seen as good overall, says Michael Posternak, co-founder and CEO of rep firm PBAC & Associates in Eastchester, N.Y. “The role of reps today is more critical and valuable to our channel partners than ever before. Largely through data from CRM-type measurements, manufacturers are looking to their reps to be their ‘eyes and ears’ in the marketplace,” he says. “Increasingly, manufacturers are interested in lead development, end user calls and pipeline data.”

These asks solidify the value of reps in the supply chain to their dealer partners as well as their manufacturers. They also help rep firms better manage their own businesses, says Posternak, but they do add administrative burdens as well.

Another added expectation, as mentioned earlier, are high-touch services like showrooms, test kitchens and corporate chefs. With more and more commodity-type products being sold online, reps have refocused on value-added and more technical items like combi ovens, rapid-cooking units, new products and other equipment that can best be promoted through pre-sale testing and live demonstrations, says Posternak. This results in well-developed leads that are then channeled back to appropriate and supporting dealer partners.

The downside of all this is the expense. In many cases, reps have full-time employees dedicated to producing reports for the manufacturers, test kitchens and corporate chefs. Such services can easily cost the firm hundreds of thousands of dollars each year.

How do reps make up that money? For Zink, who represents one of the large manufacturing conglomerates, the key is volume. Working with one large firm allows Zink to thrive based on the high sales its multiple lines bring. It’s a fair trade, he says.

With the greater sales volume, “what they’re expecting is a return on that commission,” says Zink. “That return to them is a new facility. It’s more salespeople, more culinary support. It’s a better data management system. No one’s looking to just hand people all this extra money without getting something in return. It’s a natural progression of the relationship.”

What’s more, factories are generally reasonable about how quickly a rep firm ramps up these services, Zink says. For the most part, manufacturers don’t just demand these services; they ask how they can work with their reps to get them from point A to point B.

Volume also plays a role in the strategy of PB&J Commercial Agents, an Illinois.-based rep firm that has made the conscious decision to align with independent manufacturers instead of large conglomerates.

According to Carl Boutilier, PB&J co-owner, most reps would prefer to focus on fewer lines. However, because rep groups are being asked by manufacturers to do more than ever, many have accepted additional lines to pay for those additional services.

“We have tried to avoid extremes in our strategy,” he says. “While many reps handle more than 40 brands, we’ve tried to cap our offering to 25 or so.”

Another step taken by both Boutilier and Greenwald: negotiating commissions. While the average rep commission hasn’t grown in decades, both say their companies have lobbied for commissions that are higher than the standard offering, citing additional, valuable services to the manufacturer, like enhanced marketing and brick-and-mortar facilities. This usually isn’t how reps work, but it should be, says Greenwald.

“A rep receives a contract, and they assume that there’s no ability to make changes to it,” says Greenwald. “I’m a lawyer by schooling, and I’m licensed to practice in the state of Ohio. I will tell you that no contract is stagnant. It is incumbent upon rep principals to negotiate those contracts in a way that benefits their business. It is even more important to deliver additional value to a manufacturer if you are negotiating increased revenue. We see this as both elevating the role of the rep and taking on additional responsibilities on behalf of the manufacturer.”

This position, and these strategies, may be a big change from how reps have traditionally worked, but the supply chain is changing. With more consolidation and more demands on reps, it’s no surprise that they start pushing for more themselves.