Better grab your reading glasses. That long-blurred line between foodservice and retail is getting blurrier.

In fact, if you blink these days you just might miss the moment at which businesses and brands that continue to stay in their old lanes stagnate while the market speeds toward a more integrated, omni-channel future.

Like many industry shifts already well underway, the mash-up of foodservice and retail seems only to be accelerating in the wake of COVID-19. Operators on both sides of the aisle, as well as a few new players bringing hybrid solutions to the table, continue working to meet pandemic-era challenges and fast-changing consumer demands. Retail-restaurant partnerships, third-party integrators, grocerants, “restaurmarts,” family-meal packs, cook-at-home kits, fine-casual c-stores, delivery subscriptions, you name it, it’s happening right now — in-store and online — and bringing potential long-term changes to market.

For many foodservice operators, crossing the aisle into retail is vintage stuff. For years Cracker Barrel Old Country Store, Planet Hollywood, Hard Rock Café, Cooper’s Hawk Winery & Restaurant and others have designated a percentage of their restaurants’ square footage and online sales efforts to retail merchandise. They’ve made shopping part of the guest experience, and while many such full-service restaurant players must now fight back against sharp declines in both restaurant and retail sales, others are seizing the moment to create new hybrid models suited for today and for the future.

Restaurant-to-Retail Therapy

In April, Just Salad, a New York City-based fast-casual chain with nearly 50 units offering salads, wraps and bowls, added Just Grocery to its delivery offerings. Now, Just Salad customers can click to access delivery of groceries and DIY Just Salad meal kits. Retail products available include plant-based proteins, almond milk, a variety of raw proteins, fresh fruits and vegetables sold whole or precut, pantry staples, snacks, beverages and more. Initially available only in Manhattan, the service has expanded to include Brooklyn and parts of New Jersey. Its success has the Just Salad team working on another new initiative, still under wraps as of late August, that could “transform Just Grocery and Just Salad into something bigger,” says CEO Nick Kenner.

“Just Grocery was a strategic addition to the business that allowed us to meet changing demand when the pandemic hit,” Kenner says. “The impact to the restaurant industry has been extraordinarily hard, but Just Salad is in a good place to continue to innovate and develop new ways to drive business. I’m proud of our team for launching an entirely new brand under Just Salad, which included the website, e-commerce platform, marketing and operations. We’re excited to continue to build on our core business.”

The owner of El Che Steakhouse & Bar created a pop-up butcher shop when COVID-19 hit and plans to continue to develop the retail strategy.

The owner of El Che Steakhouse & Bar created a pop-up butcher shop when COVID-19 hit and plans to continue to develop the retail strategy.

Independent chef-owner John Manion opened El Che Steakhouse & Bar in Chicago in 2016. He, too, has looked outside the box to weather the COVID-19 storm and build on his core business. Early this summer, Manion added a retail element to El Che, an unforeseen move that has proven to be both profitable and energizing.

“When COVID-19 hit and we were forced to shut down, we were sitting with thousands of dollars’ worth of prime beef in the walk-in,” he says. “We had to move that inventory or lose it.”

To move it, Manion used social media and email marketing to promote a pop-up butcher shop. Customers could place orders ahead for curbside pickup. His entire inventory sold out quickly. After a couple more successful pop-up events, the seed was planted to develop a more permanent retail strategy that could keep El Che’s customers engaged, staff working and revenue coming in while inside dining is limited.

“I had never considered retail. I’m a restaurant guy,” Manion says. “But one thing I learned is that buying a beautiful, prime steak, wrapping it in butcher paper and twine, and putting it in a nice bag to hand over to a customer is a lot easier than opening and operating a restaurant. After a particularly busy Memorial Day weekend pop-up, it was apparent to me that there was demand for this.”

So apparent, in fact, that Manion has reconfigured the restaurant’s entry area, installing a butcher shop display case and open shelving units, and adding a Meat Market section to its online ordering. The retail operation, marketed as El Che Meat & Provisions, sells USDA Prime, dry-aged beef and other raw proteins, house-made condiments and sauces, meal kits, grilling vegetables, wine boxes, cocktail kits and premade cocktails, even charcoal for the grill and a branded tote bag. Manion more recently added specialty knives, aprons, Argentine-style cookies, locally roasted coffee beans and Yerba Mate to the retail mix.

“I feel like it’s a well-curated selection,” Manion says. “I’m still pretty micro on this, but I’m looking to go macro. Like everyone else right now, we’re trying to figure out how to add revenue and get through this year. Growing this aspect of the business in the short-term is necessary, but I also see it being a longer-term addition that complements the restaurant brand and creates a niche experience for guests.”

In nearby Northbrook, Ill., Prairie Grass Café chef-owner Sarah Stegner also continues to take new approaches to building revenues, positioning the restaurant as an experiential source for direct-to-consumer meal solutions. With dining room capacity limited and customers doing more at-home cooking, Stegner began offering Zoom cooking demos. Open to anyone, the demos introduce local farm partners and encourage viewers to cook along with the chef. Rather than send them to a grocery store to pick up ingredients, however, Prairie Grass sells convenient “cooking packages” that can be pre-ordered and picked up curbside the day before the demo.

For a scallop dinner class in late August, the $45 cooking package for two included fresh scallops, eggplant, capers, ground cherries, Carmen peppers, gold cipollini onions and cherry tomatoes. Customers could add a bottle of Chenin Blanc to the package for $22.50.

The restaurant’s specials menu now includes cook-at-home options as well. On Sundays, customers can place orders for next-day pickup of a variety of raw seafood items and for “Kids Kitchen Crew Activity Kits,” containing pizza dough, toppings and raw cookie dough for at-home baking. LTO grilling kits for Labor Day weekend included skewers of raw, marinated beef tenderloin or chicken with prepared sides and desserts for two. Prairie Grass also offers house-made sauces, dressings, stocks and cookie dough for sale from its call-in “grocery store.”

Chains, too, continue to venture into more retail-style food offerings and kits designed to serve families or small groups. Taco Bell and Tijuana Flats offer at-home taco bars. California Pizza Kitchen touts its new CPK Market, selling bake-at-home pizzas and other entrees. Shake Shack, which has long offered a variety of branded merchandise for sale, this summer introduced ShackBurger Kits available nationally through online marketplace Goldbelly. The kits come complete with the components customers need to create 8 or 16 signature ShackBurgers at home.

In April, Chick-fil-A brought back two-portion Chicken Parmesan Meal Kits for $14.99. Initially tested in 2018, the kits feature premeasured and ready-to-heat ingredients and step-by-step cooking instructions. This year, the chain also began packaging its sauces for retail sale. Customers can now add 8-ounce bottles or tubs of 5 different Chick-fil-A sauces to their drive-thru and delivery orders at restaurants nationwide, or find the sauces on Amazon and at select retailers, including Walmart, Target and Publix.

Getting Shelf Space

Indeed, a growing number of restaurant brands have taken a packaged product route to establishing a presence in traditional grocery stores. Well-established examples of partnering via licensing agreements with retail food manufacturers include California Pizza Kitchen, P.F. Chang’s, TGI Fridays, Taco Bell, Arby’s, Red Lobster, Cheesecake Factory and many others. Such deals, which make popular and trusted brands easily available to grocery shoppers, help retailers distinguish their product assortment without huge investments in development and marketing and provide a way for restaurants to expand reach and revenue.

Strategic brand licensing agency Beanstalk expects increased activity in the post-COVID-19 environment. A company spokesperson noted recently in License Global, “As consumers reduce shopping frequency and cook more at home, more food, beverage and especially restaurant brands will develop licensing programs to not only diversify their revenue, but also to gain or increase the brand’s presence at essential retail.”

New York City-based The Halal Guys, a fast-casual concept with nearly 100 units, is doing just that. In early March, even before the pandemic hit, the company announced a licensing partnership through which its products will be available in grocery and specialty shops. CEO Ahmed Abouelenein noted in the announcement, “Offering our fans around the world the chance to buy our products at their local grocery store is a major step in our strategic global growth plan.”

Introduced in 2016, Dickey’s retail program has grown significantly, both in products offered and in grocery-store and online sales of packaged products for at-home preparation.

Introduced in 2016, Dickey’s retail program has grown significantly, both in products offered and in grocery-store and online sales of packaged products for at-home preparation.

Dickey’s Barbecue, a fast-growing QSR with more than 500 units in 44 states, is also capitalizing on retail. The legacy brand launched its restaurant-to-retail effort in 2016 as a modest, limited initiative, according to Laura Rea Dickey, CEO of Dallas-based Dickey’s Barbecue Restaurants Inc. It has since expanded significantly in both product assortment and retail reach. Dickey’s sauces, spice blends, canned beans, yeast rolls, sausages, meal kits and even the hardwood pellets used in the restaurants’ smokers, can now be purchased online and at more than 22,500 grocery stores in 22 states.

“We started mainly because we kept getting requests from guests who wanted to use our products at home and to include with gift cards,” Dickey says. “We sold a few items displayed in our restaurants and online but quickly got interest from retail grocery partners. The line has since grown and we’ve partnered with leading retailers, including Walmart, Kroger, IGA, Albertsons, Safeway and others.”

Dickey says the chain’s retail efforts are particularly important now, with consumer purchasing shifts and retail supply-chain challenges introducing new opportunities.

“The current situation is part of what has led us to continue our retail expansion,” she adds. “We’ve seen huge growth and requests from our retail partners to expand. Walmart, for instance, initially carried three of our bean flavors, but they now carry all five. That opportunity came to us due to a supply issue: One of their other bean brands couldn’t fulfill demand because of COVID-19. We control our supply a bit differently, so we could meet that demand. We’re now working to extend what was a short-term contract with Walmart because the products are selling so well.”

A broad shift toward online purchasing among consumers is also creating new opportunities for Dickey’s. Overall, online sales represented 26% of the chain’s pre-COVID-19 volume, but by early August, more than 90% of sales were being generated online. And ticket average, both for restaurant orders and for retail orders placed online, was up.

“With the growth in online ordering, we’ve seen huge growth in sales of our packaged, retail-style products available through our retail partners’ sites as well as through our own microsite,” Dickey notes. “We’ve been around for 79 years, and we have a very diverse customer base. Many of our guests had not previously been doing business with us online, but they’ve now started doing so. We introduced new family packs, which have been very popular, and guests are adding our packaged sauces and spices to compliment those orders. We also started getting requests for subscription-type meals and the ability to purchase meats directly from Dickey’s along with our other products. We first adjusted to that in the restaurants, where folks could place an order ahead to get meats as they would from a butcher to barbecue or grill at home. It’s a natural extension for us to take that online.”

Dickey’s now plans to introduce subscription plans that will enable customers to sign up to receive deliveries of fresh meats, sausages and their choice of sides and fixings at regular intervals.

Next-gen c-store Choice Market targets urban Millennials’ need for convenience and desire for clean, local, organic, better-for-you foods. In its newest Denver unit, classically trained chefs prepare elevated grab-and-go and seasonal fine-fast-casual foods for dine-in, pickup or delivery.

Next-gen c-store Choice Market targets urban Millennials’ need for convenience and desire for clean, local, organic, better-for-you foods. In its newest Denver unit, classically trained chefs prepare elevated grab-and-go and seasonal fine-fast-casual foods for dine-in, pickup or delivery.

Grocers, C-Stores Cross the Aisle

Still other restaurants are working their way into the retail arena through collaborative partnerships. In some cases, grocers are teaming up with local restaurants and providing opportunities to sell restaurant-prepared meal solutions in-store. Many grocery and c-store brands, too, are working to reimagine and reinvigorate their own on-site retail-foodservice programs, introducing new “grocerant” concepts, food courts and food halls, coffee and wine bars, even drive-thrus.

Iconic East Coast c-store brand Wawa, which sells more than 60 million made-to-order sandwiches each year, in addition to other fresh sandwiches, burritos, combo meals, breakfast items, and smoothies, already offers delivery via third-party services. But the chain’s newest store, slated to open in December in Falls Township, Pa., will introduce a new prototype that takes it farther into restaurant territory. Designed for curbside pickup and drive-thru only, the 1,850-square-foot location represents Wawa’s first foray into drive-thru, but likely won’t be its last.

“We are hoping to learn from the layout, workflow and traffic flow at this location, as we continue to explore alternatives for longer-term application to our stores post-COVID-19,” noted Terri Micklin, Wawa’s director of construction, in the company’s announcement.

Other c-stores also continue to take big strides across the line between retail and restaurant. Brands like Chicago-based Foxtrot and Denver-based Choice Market, for example, effectively put to rest any lingering notion of c-stores as simply pit stops for fuel, tobacco, coffee and roller-grill hotdogs.

Foxtrot bills itself as an upscale convenience store offering on-site shopping in bright, modern stores as well as app-based ordering for delivery within an hour. Products range from craft beer and natural wines, to snacks, specialty cheeses, pantry items, coffees, gifts, fresh sandwiches, salads, bowls and entrees. With eight stores in Chicago and two in Dallas, the company has two additional stores set to open in the Washington, D.C., market this fall.

Mike Fogarty, who founded Choice Market in 2017, says lack of innovation in the c-store and retail grocery channels led him to develop a next-gen alternative, one crafted to meet urban Millennials’ need for convenience and their desire for clean, local, organic and better-for-you foods. The brand’s third location, opened in July, is the largest to date, at 2,600 square feet. It’s the first to include fuel pumps and charging stations for electric cars and self-order kiosks. In-store seating accommodates guests who choose to dine in and/or grab a meal or beverage while their vehicles charge.

The new location’s kitchen, staffed by classically trained chefs, produces a seasonal, “fine-fast-casual” menu of breakfast items, bowls, salads, sandwiches and smoothies. It also serves as a commissary where grab-and-go items, sauces and specials, such as house-made vegan meatballs, are produced for distribution to all stores.

Sales are a 50-50 mix of foodservice and retail items, with 20% to 30% of foodservice sales being grab-and-go versus made-to-order, according to Fogarty. Retail items, many of which are cross-utilized in the kitchen, comprise roughly 2,500 SKUs.

Choice Market offers app-based ordering, delivery and pickup, and has a fully automated mini-market model in the works for future development. A fourth Denver store is set to open later this year and more are planned for other Colorado markets next year. “Our mission is to make good food accessible and affordable,” Fogarty adds. “For us, that means multiple formats, some with parking and fuel, some urban with no parking or fuel, some incorporating artificial intelligence-based vending machines, and some being fully automated, frictionless markets. This really is a multichannel or omni-channel company.”

Foodservice activity is brisk on the more traditional side of the grocery aisle as well. Kroger’s new two-story, urban-concept store in downtown Cincinnati, for example, includes The Eatery, a 7,000-square-foot food hall featuring five restaurant concepts, a full-service bar, patio and walk-up window for coffee and beverage service. And in June, San Antonio-based grocery chain H-E-B opened a new 130,000-square-foot store in South Austin that incorporates curbside and home delivery services and the first drive-thru window for the company’s True Texas BBQ brand of in-store restaurants, named the best barbecue chain in Texas in 2019 by Texas Monthly magazine. Now operating in a dozen H-E-B stores, the restaurants offer smoked and barbecue meats by the plate or pound, sandwiches, breakfast tacos, sides and salads. The new store also includes a large grab-and-go section with fresh sushi, prepared meal options and culinary demonstrations.

Back in 2015, Whole Foods Market took its already robust approach to offering restaurant-style prepared foods options a big step further, introducing the Friends of Whole Foods Market program, which offers select restaurant brands the opportunity to establish their own independent operations within Whole Foods stores. The program kicked off with ESquared Hospitality’s vegan fast-casual brand by CHLOE setting up shop within a Whole Foods Market in the Silver Lake neighborhood of Los Angeles. Last fall, the grocer opened two stores in the Atlanta market, for which it partnered with Los Angeles-based concepts Loteria Grill and Cold Cocked Coffee, as well as local favorites dtox juice and Sublime Tree. This summer, a new 46,000-square-foot store opened in Washington, D.C., which includes a PLNT Burger fast-casual restaurant. It’s the fifth unit for the chain, founded by chef Spike Mendelsohn, all of which are inside Whole Foods stores.

St. Louis-based Schnuck Markets, which operates 113 grocery stores in 5 Midwest states, may not have its own on-site restaurant, but it does sell restaurant meals. This April, the company launched a new program specifically created to help local restaurants during the pandemic by selling their prepared food items in St. Louis-area Schnucks stores. Promoted in-store and online, the Local Grab and Go initiative was expanded in July, bringing seven Black-owned St. Louis restaurants in as a gesture of support for the Black Lives Matter movement.

Andy DeCou, deli and specialty cheese category manager at Schnucks, coordinates the program and says that as of mid-August, it had generated more than $300,000 in sales for the restaurants, who package, deliver and stock their own products, with Schnucks providing guidance. “The restaurants are grateful for the exposure and the extra revenue stream, and our customers love having easy grab-and-go access to dishes from some of their favorite local restaurants, as well as the opportunity to continue to support those businesses.” DeCou says. “We started it because of the pandemic, but we plan to continue with it and expand it.”

Restaurant delivery platform DoorDash debuted DashMart in August. The online c-store offers on-demand delivery of a variety of household and grocery products, as well as branded restaurant products packaged for retail. Photos courtesy of DoorDash

Restaurant delivery platform DoorDash debuted DashMart in August. The online c-store offers on-demand delivery of a variety of household and grocery products, as well as branded restaurant products packaged for retail. Photos courtesy of DoorDash

H-E-B and Michigan’s SpartanNash also launched programs this spring to make meals prepared by local independent restaurant partners available in select stores. Like Schnucks, the companies hail the partnerships as wins for consumers, participating restaurants and the grocers, and say they intend to continue and grow them.

Terry Black’s, a renowned barbecue restaurant with units in Dallas and Austin, Texas, this summer announced a new partnership with Tom Thumb supermarkets, a division of Albertsons, as part of a pandemic-induced business model shift. Co-owner Mark Black said in the announcement that the move to sell products at retail was made in response to changes in how consumers dine out and shop for groceries. It is also helping grocers meet supply-chain challenges during the pandemic. Five Dallas-area Tom Thumb stores now carry two Terry Black sausage varieties, plus smoked and seasoned turkey, beef ribs, pork ribs and brisket.

Not all such partnerships and cross-pollination strategies are grocer- or restaurant-driven. Foodservice distributors, for example, and third parties in the online marketplace space are seizing new opportunities help players on both sides survive and grow by bringing them together.

National broadline distributor Sysco, for example, earlier this year created a Pop Up Shop program to help restaurant customers add retail elements to their businesses. At the height of the program, more than 16,000 operators had set up shops in their restaurants and/or via online stores from which customers could shop for retail items for delivery or pickup.

In the New York market, Baldor, a regional distributor that services high-profile restaurants and specialty markets, recently opened online ordering to consumers and launched a new Restaurant Series program, making signature dishes from top restaurants available for home delivery. Designed to help support the restaurant community during the pandemic, the Restaurant Series has taken off, according to Baldor CEO TJ Murphy, who in August announced several additions to the program. Currently featuring New York City restaurants, Baldor plans to expand the program to include other leading restaurants within the company’s broader service area.

Pure e-commerce players are also accelerating the blending of foodservice and retail though platforms that give consumers seamless access to both. Restaurant delivery service DoorDash, for instance, has added grocery retailer and c-store partners’ products for on-demand delivery. And in August the company debuted DashMart in eight markets. Pitched as a new type of c-store, the service offers on-demand delivery of a variety of household and grocery products, as well as branded restaurant products packaged for retail. Examples include Cheesecake Factory frozen desserts, Girl & the Goat chef Stephanie Izard’s This Little Goat sauces and spice blends, and Nando’s PERi-PERi sauces.

In the end, and especially in the current environment, bringing restaurant and retail together in both new and familiar ways is becoming an imperative, according to Dickey.

“Guests now want to have that Amazon.com-type experience,” she says. “They want it when and how they want it, no matter what they’re buying. And they’re shifting their behavior. They’re dining out less traditionally and cooking more at home. They still want the foods and brands they love, but in some cases they want to prepare them on their own, and maybe for a few meals at once, versus relying solely on traditional takeout and delivery. Those of us who are not just going to survive but thrive again really have to listen hard to our guests, be flexible and diversify our revenue streams. Retail and new at-home meal solutions are exciting opportunities to do that.”

Retail-Foodservice Insights: Q&A with “The Supermarket Guru” Phil Lempert

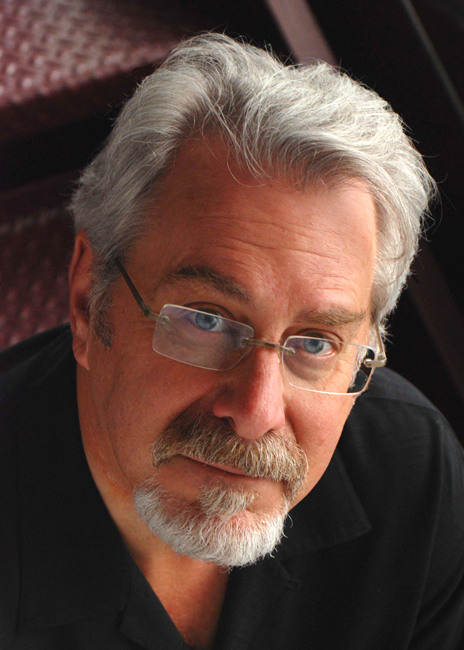

Self-described “Supermarket Guru” Phil Lempert, a long-time industry analyst and trendwatcher, says complacency and lack of innovation among grocers is partly to blame for a slowdown in traditional supermarket foodservice growth over the past couple of years. But he also sees opportunities ahead for both grocers and foodservice operators to meet changing consumer needs and expectations. Here’s what’s on his radar:

Self-described “Supermarket Guru” Phil Lempert, a long-time industry analyst and trendwatcher, says complacency and lack of innovation among grocers is partly to blame for a slowdown in traditional supermarket foodservice growth over the past couple of years. But he also sees opportunities ahead for both grocers and foodservice operators to meet changing consumer needs and expectations. Here’s what’s on his radar:

FE&S: Supermarket foodservice was pretty buzzy a few years ago. What’s changed? Why the slowdown?

Lempert: Originally, grocery retailers were intrigued by the idea of bringing a foodservice operation, or grocerant, within their four walls. It added excitement, aromas, community experience and the chance to differentiate. A few grocers still do extraordinarily well with in-store restaurants, but on a fairly large scale we quickly went from experiential foodservice to retailers doing it just because they felt they had to. We lost the emotion; we lost the fun. Grocers couldn’t hire enough chefs away from restaurants to do on-premises preparation, so they’d call up major food companies and start buying prepared, frozen items. You can go to any supermarket today and find meatloaf and mashed potatoes in a black plastic container. That’s not foodservice, but that’s what much of the industry has devolved to.

FE&S: What’s your take on restaurants moving toward adding retail options?

Lempert: Pre-COVID-19, people would go to a supermarket 2.2 times a week on average, and out to a restaurant for either lunch or dinner 4.5 times a week, according to Zagat. If we look at those metrics, it makes a lot of sense for restaurants to add retail elements in the post-COVID-19 environment. Consumers are now focused on minimizing trips to the store. If you look at the top 20 items sold in a supermarket, why shouldn’t restaurants sell them, too? Why shouldn’t a restaurant have a little area merchandising chef-prepared meals?

FE&S: Are retailers capitalizing on that same opportunity — to offer new restaurant-style options to shoppers?

Lempert: Yes and no. They want to capture those sales, but the grocery shopping experience over the past few months has become unpleasant. Everyone’s wearing a mask or fighting about not wearing a mask. Consumers used to spend 22 minutes in the store, on average. Now, they’re trying to get in and out as quickly as possible. A lot of grocery retailers have simply emptied out salad bars or other self-serve departments near the deli or back of the store and filled them with prepared foods packaged in plastic. Some are selling OK, but again, it’s a short-sighted strategy.

Especially now, if retailers want to capture foodservice sales, they have to put those offerings at the front of the store so consumers can quickly grab them and go. They have to merchandise them and make them attractive. If they want to continue to capture the dollars that they’ve grabbed away from restaurants, they need to focus not just on convenience, but on excitement, flavor, authenticity and chef-driven experiences. If they can’t do it on their own, it’s a really great time for them to partner with local restaurants to do so.

FE&S: What’s one big retail-foodservice opportunity that should be getting more attention right now?

Lempert: Health. I saw a survey report this summer that showed 72% of people had gained 16 pounds since the start of the pandemic. Not everyone wants to eat healthy, but when we come out of this, a lot of Americans are going to focus on getting and staying healthy. That’s a very big opportunity for foodservice, whether retail, restaurant or hybrid, to develop recipes and merchandise delicious prepared meals and kits that are chef-driven, convenient, and full of healthful, immunity-boosting ingredients.