Despite the May sales increase at foodservice and drinking places, the restaurant industry faces a long road back. Surveys show manufacturing sector is picking up, and Foodservice receives more media coverage. McDonald’s results show the complexity of ever-changing industry dynamics.

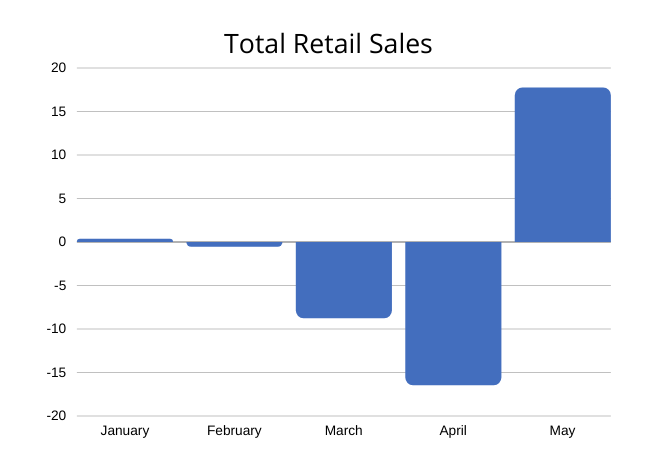

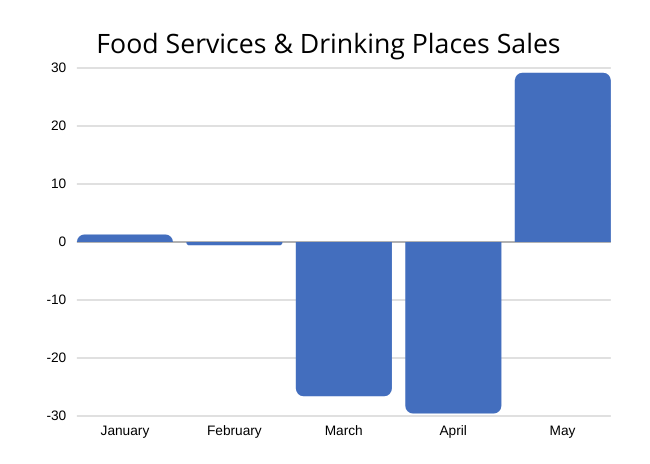

Many have said there’s no guidebook for dealing with the pandemic, and they are right. Thus, forecasting in such an environment remains extremely difficult. For example, while most, but not all projections called for sales to increase as more businesses reopened, the size of the rebound caught the forecasters unawares. Here is a quick look the Census Bureau sales figures so far this year:

While any improvement is a positive sign, it is also obvious that one month can’t cover all the previous losses. Both total retail sales and foodservice sales gains in May covered the sales declines from April. Even with the strong bounce back in May, restaurant and bar sales are down 22.3% in the first 5 months of this year. May 2020 sales of $38.6 billion are far below the May sales of $63.7 billion in 2019. The restaurant industry continues to climb out of a very deep hole.

Economic News This Week

- Initial-jobless claims totaled 1.51 million for the week ending June 13, a decrease of 58,000 claims from the previous week. The 4-week average totaled 1.77 million, a decline of 234,500 claims. The number of claims filed has exceeded 1.5 million for two consecutive weeks.

- Industrial production increased 1.4% in May from April, per the Federal Reserve’s G.17 Report. Total industrial production was 15.3% lower this May than it was in May 2019. Manufacturing output rose 3.8% in May after falling sharply in both March and April. Mining output declined 6.8% and utilities output fell 2.3%. Capacity utilization for the industrial sector increased 0.8% in May, a rate that is 15.0% lower its long-run (1972-2019) average and 1.9% less than its trough during the Great Recession.

- The Philadelphia Federal Reserve’s Manufacturing Business Survey showed considerable improvement in June. Most current indicators rebounded into positive territory. (Any reading exceeding zero indicates growth.) The overall index rose sharply from minus 43.1 in May to 27.5 this month. The New Orders Index increased to 16.7 from minus 25.7 in May. The Shipments Index rose to 25.3 from minus 30.3 last month. The Unfilled Orders Index increased significantly but stayed negative at minus 0.1. The average workweek showed slight improvement but stayed in negative territory. The Number of Employees Index rose to minus 4.3 from minus 15.3. The results of the survey, if correct, show phenomenal improvement, at least in the region served by the Philadelphia Fed.

- Privately owned housing starts increased 4.3% in May from April but were down 23.2% from May 2019. Single-family housing starts were up 0.1% compared to April. The number of Building permits issued for privately owned housing units increased 14.4% from April but were down 8.8% from May 2019. The number of permits issued for single family units were up 11.9%.

- The Conference Board’s Leading Economic Index improved in May. The Index rose 2.8% to a level of 99.8% after falling 6.1% in April and 7.5% in March. A spokesman for the Conference Board said the initial shock to the economy may be behind us but the recovery “remains highly uncertain.”

Foodservice News This Week

- One interesting result of the pandemic is that it generates a lot of news coverage of the restaurant business. Prior to this year it seemed the consumer media and the general business media might go weeks without any news about foodservice. The Wall Street Journal is a good example of a source that substantially increased foodservice news since the pandemic started. Unfortunately, a lot of the coverage takes on a negative tone because of all the problems foodservice faces. Some coronavirus stories freely acknowledge that many restaurants will not reopen. Take, for example, the Zinburger chain, which will permanently close most of its locations along the east coast and in Atlanta. After shuttering those locations, Zinburger will have just three stores remaining in its home state of New Jersey.

- As for the world’s largest restaurant chain, McDonald’s contrasting results shows how quickly market conditions can change. Total corporate sales fell about 30% in the first 2 months of the current quarter. Sales were hurt primarily in France, Spain, the United Kingdom and Italy. Comparable store sales in the U.S. fell 12% in the first 2 months of the current quarter. Interestingly, comps declined 19% in April but were down just 5.0% in May. One of the burger giant’s next steps to help rebuild its business is to boost advertising spending by $200 million.

- A bankruptcy court orders Garden Fresh Restaurants to liquidate Souplantation and Sweet Tomatoes, to liquidate. Equipment and contents for all 97 of the chain’s Souplantation/Sweet Tomatoes locations will be sold off.

- The numbers tell the story of Dave & Buster’s struggle to survive. On March 20, all 137 of Dave & Buster’s locations shut down due to the pandemic. Management spent the time searching for capital to keep the company afloat. Unlike a lot of other chains, it had no established takeout or delivery programs. In April, with every unit still shut down, Dave & Buster’s was eating up $6.5 million every week. The company was successful in arranging a $100 million private placement. As of early June, there were 28 units running and the company expected to have 48 up and running this past Sunday. Dave & Buster’s anticipates having 90 to 95 units open by August. Performance varies widely from location to location with the bottom quarter running at about 18% of the comparable store sales they had pre-pandemic and the top 25% running at 55% pre-pandemic.

- Comparable Restaurant Sales Reports: Ark Restaurants “Not meaningful.” and Dave & Buster’s down 58.6%.

For details and same store sales of other chains, Please Click Here for the latest Green Sheet.