The foodservice industry is changing extremely fast these days, driven by significant challenges. Among these challenges are an unprecedented labor shortage, supply-chain snarls, and changes in the ways consumers patronize restaurants. Operators are increasingly turning to automation and robotics to cope.

“Operators of all types are adjusting to their new operational normal and figuring out how to do more with less,” says Juan Martinez, Ph.D., FCSI, principal and co-founder of foodservice engineering consulting firm Profitality Labor Guru. “This includes considering many changes, such as value engineering products, reducing the menu, and streamlining labor and service.”

In January’s edition of FE&S, we looked at how new approaches continue to impact the customer — or the front of the house, drive-thru lanes, takeout and delivery services, and online and mobile interactions. Foodservice designers stress that the technology and automation streamlining these consumer contact points must always be matched by back-of-the-house improvements that help restaurants better leverage what labor they do have. These improvements also accelerate production

to better align output and food quality with consumers’ rising demands.

This month’s report examines how this all continues to play out in the back of the house.

Chipotle’s “Chippy” robot arm automizes the frying of tortilla chips, then adds salt and a squeeze of fresh lime juice. Photo courtesy of Chipotle Mexican Grill

Chipotle’s “Chippy” robot arm automizes the frying of tortilla chips, then adds salt and a squeeze of fresh lime juice. Photo courtesy of Chipotle Mexican Grill

1. Kitchen Automation in the Broader Sense

Automating kitchen functions can have a big impact on operators. “In the short term, you’ll probably see more efforts in the front of the house,” says David Henkes, senior principal at foodservice research and consulting firm Technomic. “But in the longer term, the potential ability to cut back on labor might be stronger in the back of the house.” Front-of-the-house technology can have a more immediate impact on the company’s return on investment (ROI), he explains, in part because online and mobile loyalty apps and POS systems capture so much data about the restaurant’s customer base.

In the back of the house, Henkes says, “Automation is not necessarily built on cost savings as much as improving the workers’ experience and raising morale, taking off unwelcome tasks like changing the fryer oil and reallocating workers to more valuable tasks.”

Some of the financial benefits of these changes will show up in the long term as reduced turnover and fewer hours lost due to workers’ injuries, Henkes notes. “It’s hard to replace chefs, but rote-style production probably can be replaced,” he adds. “So, equipment companies are spending a lot of time trying to automate repetitive tasks like making a pizza or building a burger.”

Do automation and robotics really cut labor? Not necessarily, Henkes says. “Most studies have shown that even as you spend a lot of money to implement a lot of technology, you’re not actually reducing your head count or FTEs [full-time equivalents],” he explains. “You still need people to make sure things are happening as they are supposed to and fix things when they go wrong. Pure automation in a restaurant is very hard to achieve.”

Creator shows off the latest version of its automated burger-making system in the lobby of its corporate office. The company even caters private parties in the space, including a demonstration of the system for guests. Photo courtesy of Creator Burger

Creator shows off the latest version of its automated burger-making system in the lobby of its corporate office. The company even caters private parties in the space, including a demonstration of the system for guests. Photo courtesy of Creator Burger

Martinez agrees by saying, “No automated device can be as flexible as a good employee, especially in making decisions on the fly and adjusting to the random arrival of customer orders.”

Operators can achieve some labor savings by moving tasks to the front of the house, says Arlene Spiegel, FCSI, founder and president of New York-based firm Arlene Spiegel & Associates. “Customers today were brought up on tech, and they have no problem making their own gourmet espresso or going to a beautiful gelato machine and making their own sundae,” she says. Liquor bars, especially, lend themselves to automation, Spiegel notes, because uniform dispensing of pours can bring down adult beverage costs significantly.

Both Spiegel and Martinez point out that operators continue to move kitchen tasks off-site, which is another form of automation. Martinez gives an example: “You used to get chicken, cut it, marinate it and cook it. But now there’s quality premarinated and even precooked chicken from suppliers that’s pretty darn good, and that can save a lot of labor. Any operating parameter, process, platform or workstation design that allows for less labor is a form of automation.” In other words, not all forms of automation require adding new equipment or technology to the back of the house.

Managing kitchen automation, like managing every other aspect of running a restaurant, requires getting a handle on logistics, Spiegel stresses. Whether the operation is big or small, “the key is having someone in the company, either on-site or in a corporate office, who understands logistics — the way things connect,” she says. “That requires technology and analytics to figure out how to be flexible enough to accommodate changing pressures and challenges of your local marketplace. If you don’t know how to manage information, technology and automation, you’re missing opportunities to take advantage of new market opportunities.”

For single-unit proprietors and big chains alike, the most obvious payback in technological innovation comes from digital preordering, Martinez says, because it enables operations to stagger specific food-prep tasks based on the expected pickup time for the order. “If you have more digital ordering, you should need less labor,” he says. “But you need to have an activity-based labor system to take advantage of it — this station requires 5 minutes, another task 10 minutes, something else 15 minutes.”

Overhead kitchen display system screens at workstations, which translate incoming POS data into specific tasks to be done at specific times, can help drive efficiency, Martinez says, as long as workers doing these tasks are given only as much information at one time as they can absorb. “That’s what we call cognitive ergonomics — how information is processed in the brain,” the consultant says. “Getting the right information to the right place at the right time is critical in driving labor efficiency. The best way to manage labor is to use an activity-based system, calculated on the time the workers take to deliver the customer experience.”

Is kitchen automation a project only for QSRs with limited menus? Not at all. Sit-down restaurants may have a hard time replacing their chefs, but there are also plenty of rote chores in these more complex kitchens.

“Full-service restaurants [FSRs] are using the same ideas, just with different items going through the kitchen,” says Martinez. “All the things that work for QSRs work for full-service, although in an FSR, the back of house is more complex. Automation makes it less complex. You can have a conveyor oven, and you can have a fryer robot. Everything is driven by the menu and by the service you’re trying to deliver.”

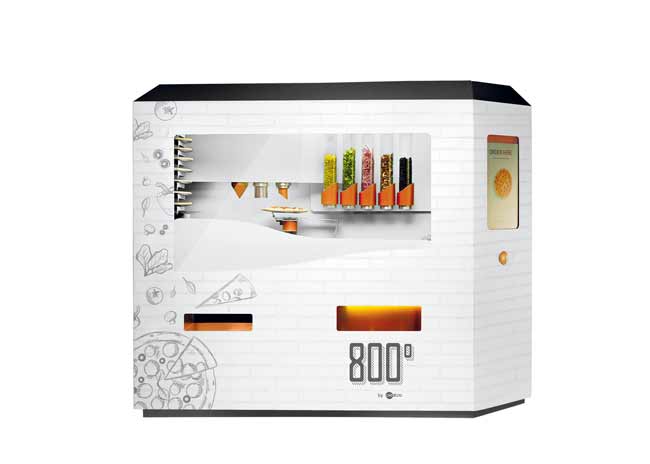

The company behind 8000 Woodfired Kitchen, 8000 Degrees Pizza and 8000 GO —self-contained kitchens for ghost-kitchen and brick-and-mortar locations — is partnering with a manufacturer to develop self-contained pizza kiosks. Able to dispense customized pizzas within 3 minutes, the kiosks would be restocked from 8000 GO locations. Photo courtesy 8000 Degrees/Piestro

The company behind 8000 Woodfired Kitchen, 8000 Degrees Pizza and 8000 GO —self-contained kitchens for ghost-kitchen and brick-and-mortar locations — is partnering with a manufacturer to develop self-contained pizza kiosks. Able to dispense customized pizzas within 3 minutes, the kiosks would be restocked from 8000 GO locations. Photo courtesy 8000 Degrees/Piestro

2. A New Way to Run a Restaurant

The terms “automation” and “robotics” often get used interchangeably, but that’s not always correct.

“Automation is anything that allows you to reduce labor in the kitchen,” Martinez explains. Automated equipment offers mechanical assistance to make human tasks easier; it might, for instance, involve a conveyor belt, as in a conveyor pizza oven, or a device for dropping preportioned foods like ketchup onto a burger or cookie dough onto a cookie sheet.

Robotics is about, well, robots. Martinez explains that a robot can be “a device that looks like a human limb, with 360-degree turns and tremendous flexibility.” The goal of this solution is to replace specific human worker tasks rather than to just make the worker more efficient.

What Industry Leaders Are Doing

The chicken-wing franchise brand Wing Zone partnered with product development incubator Wavemaker Labs in 2022 to develop Wing Zone Labs, structured as a franchisee of the brand and dedicated to pioneering automation and robotics. The current concept uses robotic arms for frying chicken and potatoes, but the long-term goal is a fully automated restaurant, with humans removed from the process of preparing food and drinks.

The salad chain sweetgreen followed up on the 2022 opening of its first all-digital preorder takeout unit and its first sweetlane digital-preorder, drive-thru unit with an announcement of a 2024 test of an all-robotic Infinite Kitchen salad restaurant with fully autonomous makelines. It will be based on technology that sweetgreen acquired in 2021 when it purchased Spyce — then a two-unit, automated bowl-meal concept — along with its proprietary robotic system developed by Massachusetts Institute of Technology mechanical engineers.

“These restaurants will serve our food with even better quality, perfect portioning and faster speed and will create a more consistent customer experience, all while elevating the role of our team members,” sweetgreen CEO and co-founder Jonathan Neman told analysts on the chain’s third-quarter 2022 conference call. sweetgreen anticipates that the new format will require only half the labor of a conventional sweetgreen restaurant, speed throughput, and boost order accuracy.

Chipotle Mexican Grill has its own venture division, which it calls Cultivate, dedicated to exploring and investing in new technology. Under its aegis, Chipotle’s Cultivate Center in Irvine, Calif., “tests recipes, concocts future menu items and pilots new technology,” explains Nicole West, the chain’s vice president of digital strategy and product. “Our restaurant excellence team works closely with field associates to identify pain points in operations; we collaborate to find solutions that reduce friction, drive efficiencies, and improve the guest and employee experience.”

The fast-casual chain is piloting an artificial intelligence-powered kitchen management system that provides demand-based cooking and ingredient preparation forecasts, as well as Chippy, an articulated robotic arm that makes tortilla chips — a retooling of a manufacturer’s existing robot designed to cook french fries. Meanwhile, the Cultivate venture fund invested in a food robotics company that has developed an automated makeline that assembles meals in seconds. “We are always exploring additional advanced technologies to drive growth and efficiencies,” West adds.

White Castle uses a fully automated system to produce all fried foods in 100 of its 350 restaurants, and is planning to add the units at more locations. Photo courtesy of White Castle

White Castle uses a fully automated system to produce all fried foods in 100 of its 350 restaurants, and is planning to add the units at more locations. Photo courtesy of White Castle

Burger Sector Boons

Although a burger-flipping robot has yet to be perfected despite years of research and development (R&D) and in-restaurant trials, the already highly automated QSR burger segment is a natural leader in the push to robotics.

Jack in the Box is conducting a unit test of a robotic arm for its fryers, as well as a POS-integrated automatic beverage dispenser. The dispenser incorporates a cup conveyor, portions beverages and ice, seals the lids onto the drink cups, and groups the filled cups in a staging area for staff members to hand to customers. Crucially, the unit can accommodate different cup sizes.

White Castle, the nation’s oldest QSR burger chain, has installed a robotic fryer in 100 of its 350 restaurants after a successful test and plans to continue adding the device to other units. The robot processes all of the chain’s fried foods, including french fries and the brand’s iconic chicken rings.

Key to the success of the unit in different configurations of White Castle kitchens was a retooling by the manufacturer to make the robotic arm swing less — and thus be less of an impediment to foot traffic, says Jamie Richardson, the chain’s vice president of marketing and public relations.

The device “has given us more consistency at the fryer and is certainly helpful to the person who once would have been at the station and is now free to take orders or encounter customers at the drive-thru,” Richardson notes. “Investment in the right technology to make our staff’s job easier and allow the kitchen to run more smoothly always pays off.”

White Castle is also moving ahead on other technologies, including a new smart menu board and ordering system and an artificial intelligence voice recognition assistant for the drive-thru.

A fully automated, self-contained restaurant in a box that dispenses prepared foods made robotically within the unit serves as an obvious way to extend the reach of fast food to out-of-the-way spots and institutional locations, from shopping malls to college campuses. The notion has had its failures — DoorDash notably pulled the plug on the self-contained salad-making Chowbotics unit a little more than a year after purchasing the company — but also its successes.

Burgers Untouched by Human Hands

The burger sector is one focus of this technology. A startup, Creator Burger, recently opened a highly automated brick-and-mortar restaurant at the Westlake Shopping Center in Daly City, Calif. The unit also showcases Creator’s self-contained burger assembly technology to customers. Guests can order a fully customized sandwich and choose precisely dispensed sauces, seasonings and toppings from among 25 choices. The finished, seared burger is dispensed in as little as 4 minutes. Although the original version of the burger-assembling machine is open to customers’ view (and is visually impressive), the brand also developed a germ-free version of the unit in a transparent box as a response to the COVID-19 era.

Another competitor is RoboBurger, billed as the world’s first fully autonomous robotic burger chef in a box. The unit, with a footprint of some 12 square feet, reproduces a 5-step process used in fast-food burger restaurants. The sequence begins with grilling an Angus patty, then toasting a potato bun and assembling the sandwich with customized toppings, producing a burger in less than

six minutes.

The original RoboBurger box is at the Simon mall at the Newport Centre in Jersey City, N.J. After the company secured investments totaling $10 million in a funding round last fall, it is now planning to install second-generation units in a Pilot Flying J truck stop in Newark, N.J.; a university in Queens, N.Y.; and the Port Authority Bus Terminal in Manhattan, N.Y.

Pizza Popped Out on Demand

The food-from-a-box idea also works for pizza. Stellar Pizza received quite a bit of publicity last fall when rapper and entrepreneur Jay-Z led a $16.5-million funding round through his venture capital firm Marcy Venture Partners. Stellar calls its food truck with a self-contained pizza-making machine a “spaceship in a box” — playing on the concept’s name, which is in itself a nod to the owners’ background as SpaceX engineers. The pizza-making process begins with a dough ball that emerges from a cooling unit, is flattened into a crust, and is topped with sauce, cheese and other ingredients, and then is popped into a stacked oven, producing a pizza in

five minutes.

800° Woodfired Kitchen is branching out with its own robotic pizza concept, 800° GO, designed to be installed in ghost kitchens (through a partnership with REEF Kitchens) as well as in brick-and-mortar units. These locations will also serve as commissaries for fully automated pizza-making kiosks dispensing customized, made-to-order pizzas within three minutes. Each self-contained unit holds enough ingredients to make around 80 pizzas before it needs to be refilled.

Creator shows off the latest version of its automated burger-making system in the lobby of its corporate office. The company even caters private parties in the space, including a demonstration of the system for guests. Photo courtesy of Creator Burger

Creator shows off the latest version of its automated burger-making system in the lobby of its corporate office. The company even caters private parties in the space, including a demonstration of the system for guests. Photo courtesy of Creator Burger

3. Foodservice of the Future

The restaurant industry is always changing, and the pace of change continues to accelerate. But there’s a difference between what can be done technically and what actually boosts the bottom line.

Large-scale implementation of automation and robotics in the kitchen remains, for now, primarily the purview of national chains. “Bigger brands with big budgets and more sophisticated formal agreements” with manufacturers taking the lead, Martinez says.

“Smaller players will have to wait and look for other solutions — more core automation, things like fry dispensers and food processors, and buying convenience products such as premarinated chicken,” Martinez says. The power divide between big and small players has been deepened by, among other things, the current supply-chain slowdown in getting new equipment to restaurant kitchens, Martinez points out. Small operations are often last in line.

Small-scale operators may in fact get “the worst part of automation,” Spiegel cautions. For them, even investing in vital technology may not bring good ROI if they’re relying on off-the-shelf software and equipment from different manufacturers. “They all have to talk to each other [to justify] paying a fee for them every month,” she says. “If there’s going to be one owner-operator or one manager in charge of that, it may not have payback. And operators trying to figure this out may be taking their eye off the ball on their relationships with customers.”

The biggest chain of all, McDonald’s, has always led the fast-food industry in adopting new technologies and equipment. But after intensive R&D, it has found no technological or robotic silver bullet, president and CEO Chris Kempczinski told analysts during the company’s third quarter 2022 conference call. Robotics, he said, are simply “not practical in the vast majority of restaurants.” Key impediments include the different footprints, varied infrastructure and HVAC demands of McDonald’s restaurants around the world. “The economics don’t pencil out,” Kempczinski concluded.

Or do they? In a recent Forbes article, journalist John Koetsier reported on an analysis of the cost-benefit ratio for a sophisticated self-cleaning robotic fryer for chicken wings. The unit has a hefty $3,000-a-month leasing fee, but that compares favorably to the cost of hiring a human worker to fry the wings. At a $7-an-hour wage, the cost of the machine is 80% of the cost of a human operator; at a wage of $15 an hour, the monthly lease fee for the machine is only 37% of the human worker’s monthly take.

“Maybe automation and robotics make sense in high-volume locations run by big chains,” says Henkes. “But you’re not going to see robots in every kitchen across the country in my lifetime.”

Martinez predicts that “efforts in robotics and automation will continue to grow, especially if labor availability stays light and the cost of labor outpaces any possible price increases that restaurants can take.” By now, there’s a long record of both successes and failures, he adds.

“Everybody’s got to make money,” Martinez says. “You can’t quantify what you’ll get until you know what you’ve got. What’s the payback? What are you trying to solve? Are kitchen automation and robotics a solution looking for a problem, or a problem looking for a solution?”

Time will tell.