With corporate feeding needs evolving in the face of COVID-19, operators react accordingly.

While restaurants were hit hard by COVID-19, business and industry sector foodservice operations have been particularly vulnerable, too. With a large number of employees working from home, the majority of America’s corporate feeders either shut their doors temporarily or pivoted to provide philanthropic meals for frontline workers.

But even in this challenging environment, many B&I sites are already on the rebound. At press time, New York City-based Restaurant Associates (RA), an on-site dining room management company and part of contract foodservice provider Compass Group, reported many clients were in the reopening process. “It is slow, but we had about 60 units in 5 cities that remained open, serving essential associates and security workers on a very limited basis,” says RA CEO Dick Cattani. “We’ve kept a good amount of our workforce active and employed.”

The months ahead look to be better with more RA units planning September openings. Still, with virus cases resurging in some states and uncertainty looming, corporate dining clients that were planning a fall foodservice opening have pushed back restarts to January 2021. “It’s been very fluid with the uptick of the virus in many states,” says Cattani. “In June and July, we had 10% to 20% of our sites open and expect 30% to be online by October.”

Before COVID-19 hit, Chicago-based Datassential had been predicting strong growth for the B&I segment, estimating it would hit $6.9 billion in operator sales this year. “But the B&I segment has been particularly hard hit by the pandemic,” says Mike Kostyo, Datassential’s trendologist.

Datassential reports nearly half of operators say their business is down 100%, while another 31% say their business is down 70% to 90%. “Now we think the segment will be down at least 30% for the year overall with offices and white collar operations down 44%,” Kostyo says. “That’s without even taking into consideration any major spikes and lockdowns that could happen in the latter half of the year.”

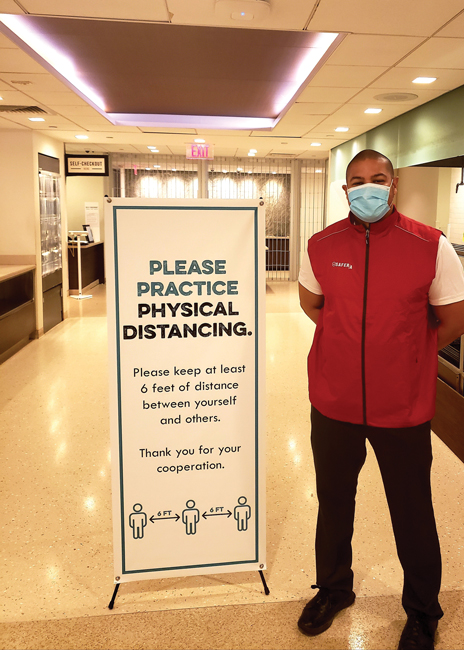

Enhanced sanitation measures are a part of Restaurant Associates’ program at its foodservice facilities.

Enhanced sanitation measures are a part of Restaurant Associates’ program at its foodservice facilities.

A Changing Environment

With the pandemic, the B&I segment was less likely than the foodservice industry overall to pivot to delivery options, reports Datassential. Along those lines, 44% of B&I operators report closing their dining rooms and switching to delivery, compared with 65% of operators overall who said the same thing. “But as employees head back to work, we think on-site delivery will increase,” says Kostyo. “Grab-and-go options will also be essential, both while employees are on-site and as they head home. Operators throughout the industry are selling produce, meal kits and even sanitization products.”

A major factor will be how many people continue to work from home. According to Datassential’s research, 76% of workers think their employers will allow them to continue working from home in some capacity after stay-at-home restrictions are lifted. “This obviously skews more toward offices than manufacturing facilities, but it has big implications for B&I foodservice,” says Kostyo.

Companies with closed foodservice facilities plan to alter their services. This includes the culinary program at Facebook, based in Menlo Park, Calif. Foodservice plays a major role in the social media giant’s office culture. “In light of COVID-19, we are working to adapt the program in new and innovative ways to ensure the safety of all our employees,” says Ryan Moore, who heads up Facebook’s financial communications team. “When our offices reopen, we will start by offering grab-and-go meals but will continue to evaluate how we manage the program as guidance evolves around COVID-19.”

The American Express setup includes plenty of space for social distancing.

The American Express setup includes plenty of space for social distancing.

Shrinking Foodservice Real Estate

“Early on, there was no end in sight; now, even though dates aren’t tangible, there’s talk about reopening,” says Robert Seth Gordon, global vice president of Workplace Services for New York City-based American Express. Gordon is also the 2019-2020 president of the Society for Hospitality and Foodservice Management, based in Louisville, Ky. “My personal feeling is this will have a longer-term impact, and there will be new methods of service.”

At American Express, the focus is on shrinking its foodservice real estate. “We’ve already proven working from home can be done, so we won’t have as many people on the premises,” says Gordon. “At the same time, we’re making it more compelling for people to come to the office by upscaling our food and offering deals and discounts.”

American Express models its back-of-the-house operations on its building occupancy percentages, and it expects 50% of workers in its installations will be back by October/November. “This helps us reduce the space we need, and we don’t have staff falling over each other in the kitchens,” says Gordon. “We separate prep tables, everyone is wearing masks and gloves, we’re putting up partitions, and delivery limits on-site interactions with staff and customers.”

For added convenience, American Express will offer on-site general store programs for employees who don’t want to make multiple stops for groceries on the way home from work. “Our focus going forward with dining is around convenience and technology,” says Gordon. “One of the big pieces is food delivery services to office floors. Why risk people gathering for dining when we can offer staggered deliveries throughout the day?”

In a new initiative, American Express developed a base protocol list for its foodservice associates. “Restaurant Associates [which runs the Amex program] has its safety protocols, and we have our own,” says Gordon. “Ours are specific for each of our locations and deal with spacing, the food stations that are open and how to safely move customers around.”

There have been no changes with American Express offices’ pantries, which already included spigots and beverage dispensers hidden underneath counters, meaning they were never touch points. “We have, however, taken out ice bins in our New York City sites, replacing these with 40 water systems in break rooms and pantries,” says Gordon. “We also separated microwaves to different sides of the room to stop people from congregating.”

American Express is not currently offering catering at its B&I installations since conference services were not fully operational at press time. “We don’t want to put food in a room like in the past [for associates to help themselves],” says Gordon. “When we do resume these services, we will have a masked and gloved staff member serving food, then removing leftovers from the table afterward. We’ll also provide a prepackaged food option.”

In addition to added vigilance with cleaning procedures, American Express has implemented a more extensive signage program. “This creates a journey mapping from when associates enter the building,” says Gordon. “We also have 74 pages of employee guidelines from pantries to bathrooms to cleaning schedules, making sure everyone is safe. So many people are nervous right now; the best thing we can do is alleviate their fears.”

Comfort Foods May Have the Edge

Prior to COVID-19, the B&I segment had been adding a number of innovative menu items. “Options that once had been limited to only those hip Silicon Valley offices were trickling down to offices and cafeterias across the country,” says Kostyo. “You were seeing more global options, a lot of healthy and plant-based menuing, more grab-and-go items and micromarkets, and a lot of food hall-inspired operations.”

Nearly two-thirds of B&I operators reported to Datassential that they had added plant-based substitutes to the menu before COVID-19, while nearly 60% said the same for global foods and flavors.

“In the short term, as B&I locations reopen, we’ll likely see more menuing of comfort food favorites like pizza, pasta, burgers, etc.,” says Kostyo. “Consumers also tell us they are looking for healthy options that boost their immune systems during the pandemic, so B&I operators can offer more superfoods, items with vitamin C, etc.”

One major change, however, will likely be fewer items on the menu. Fifty-six percent of B&I operators said they plan to reduce the size of their menu, according to Datassential. “We see this across the industry, but it’s not surprising to see it in B&I, where there are concerns about limited staff, many employees continuing to work from home, supply chain issues and budget concerns,” says Kostyo.

RA simplified its daily menus while at the same time planning more robust catering offerings. “We’re fortunate to have catering kitchens in New York, Boston, Washington D.C., and Albany,” says Cattani. “We’re seeing interest in delivering boxed meals to sites.”

In most of its operations, salad bars won’t initially be introduced; RA will primarily offer packaged menu items. Although RA is not physically changing its back of the house, it is reducing headcount in its kitchens, which helps consolidate production. “We can’t have two people working a saute station anymore as we have to rethink everything due to six feet of required distancing,” says Cattani. “Everyone will be separated during production.”

In the front of the house, name badges will verify RA staff who have been fully trained and certified. “We have addressed past experiences from other countries, like China, which found signage was critical not only in giving direction but also providing a comfort level that everything is being covered and in place,” says Cattani.

American Express’ operations will combine prepared and made-to-order items along with grilled foods as part of a more upscale menu that rotates weekly. “Much of my team’s work is about the service experience, which includes avoiding lines, offering comfort foods, limiting people in the cafeteria and creating new positions that ensure sanitation is being taken care of,” says Gordon. “We’ll also continue our focus on sustainability with our current packaging provider.”

Though much of the menu streamlining is a result of reduced volume, this may not go on indefinitely. “Some may go back to original menus or a modified version when they get a better feel for how many people are coming back to work,” says Orlando Espinosa of Cini Little. “And although sustainability will not go away no matter what happens, it will present greater challenges.” He estimates a 50/50 split between disposables and permanentware use in the future.

Obviously, with menu changes, the biggest impact is on self-service in the front of the house, conference rooms and satellite breakroom kitchens. “Most people are saying they will have attendants, so you have to identify the most efficient way to provide the same level of service with a no-touch experience,” says Espinosa.

As B&I operators move forward, flexibility becomes even more critical. This includes the ability to modify food shields so staff can use them for either self-serve or full-serve formats.

Labor costs represent a key consideration in addition to safety. “If you have additional points of service that will increase labor costs, the contract manager may be able to pass that cost on to the client,” says Espinosa. “In other cases, an operation may have minimal staff that serves salad and soup at the same time, combining multiple self-serve stations into one full-serve station.” He adds that for added transparency, B&I will need more food prepared in front of clients, like prep and assembly; bulk prep can still be accomplished in the back of the house.

“Serving area sizes will be increasing due to social distancing, and operators will need to work with spatial issues in the front of house,” says Espinosa. “It’s assumed those ordering on the phone will pick up food and eat somewhere else.”

Impact of Innovation

Restaurant Associates’ new protocol includes safety concierge and signage that specifies expectations.Datassential reports that B&I operations were investing in a number of technologies prior to COVID-19 that now make even more sense. These include unmanned micromarkets, robotic preparation machines, and on-site hydroponic or aquaponic systems, which cultivate plants and aquatic animals, respectively, in a symbiotic environment.

Restaurant Associates’ new protocol includes safety concierge and signage that specifies expectations.Datassential reports that B&I operations were investing in a number of technologies prior to COVID-19 that now make even more sense. These include unmanned micromarkets, robotic preparation machines, and on-site hydroponic or aquaponic systems, which cultivate plants and aquatic animals, respectively, in a symbiotic environment.

“Anything that can cut down on touch points or replace buffets and self-service options will be attractive to the segment,” says Kostyo. “Before COVID-19, one out of five B&I operators told us they planned on adding self-serve stations this year; now, 77% say they’re discontinuing hot bars, 73% say they’re removing salad bars, and 65% say they’re getting rid of condiment stations. With some B&I operators working with a reduced staff, technology that assists the back of house could be attractive as well, though budget concerns overall will impact technology purchasing.”

American Express has a robust technology program for online ordering and app payments. “We’re finding ancillary opportunities and new ways to handle sales,” says Gordon. “Providing staggered deliveries throughout the day, for example, alleviates the pressure on elevators and vertical transportation.”

Although food ordering via smartphones and kiosks is not new, these technologies have been fine-tuned and are expected to grow in the current climate. “Many equipment manufacturers are looking at new or modified equipment to address COVID-19 concerns, and these will come to market soon,” says Espinosa.

One company that had 16,000 employees on a campus that is two-thirds shut down questioned whether to provide food options for those working from home. “Whether that is done through the on-site operator or a third-party delivery company [remains to be seen],” Espinosa says. “What is the future of mega buildings now that there is a comfort level with working from home? What impact will that have on building size and occupancy rate? Much of that is the culture of the organization.”

RA has put technology at the forefront with webinars addressing the topic and its impact on the future of B&I feeders. “Whether it’s a kiosk or app, it’s all about noncontact and not interfacing with staffing,” says Cattani. “We’re working with a robotics company to introduce a salad bar that’s manned by robots. We have a couple test sites coming online next month.”

While many admit they are learning as they go with new innovations, the consensus is that the B&I foodservice segment will look and operate differently in the years ahead. “We all want to be leaders and on the cutting edge in our business, but we need to walk in step,” says Gordon.

Safety at the Forefront

“Safety protocol is clearly our biggest priority,” says Dick Cattani, Restaurant Associates’ (RA) CEO. “We checked in with associates in Europe and China that were ahead of us and had conference calls with [our parent company] Compass Group’s colleagues in other countries to see what they learned and experienced as well as what went well and what didn’t. So, we had a good handle on that.”

RA Advisory Board members include a slew of industry experts: Beth Torin, former executive director for the New York City Department of Health Office of Food Safety; Dr. David Buckley, director of Retail Food Safety and a virologist; Ted Diskin, president of Health and Sanitation Systems and a registered sanitarian; Lena Darrell, a registered sanitarian and dietitian who managed quality assurance for Compass Group for the last six years; Amanda King, workplace safety manager for Compass Group for the last 10 years; and Aaron Salsbury, vice president of Data Analytics.

As RA’s COVID-19 safety czar, Anthony Capozzoli will oversee the company’s safety initiatives and protocols moving forward. “The board meets weekly with Anthony and receives input from the field and questions from clients as well as all guidelines from federal, state and local officials,” says Cattani.

The Advisory Board will function as a think tank, examining information and guidelines to form protocols, counseling operators and clients, and guiding internal and external communications as well as sharing best practices across business sectors and industries. “What’s been terrific is our clients can utilize Anthony and the board on an ongoing basis to answer questions,” says Cattani. “And every week, we’re getting new products in this field, such as uniforms, safety shields, chemicals, sanitizers, etc., that the board reviews, then decides what to recommend and what to take a pass on.”

A network of RA COVID-19 safety champions across the regions will support the program’s implementation and auditing, manager and team member training, and coordination of cleaning and sanitizing services through RA’s sister sector, Eurest Services.

“We’ve also launched a few webinars for clients and operators with as many as 600 attendees,” says Cattani. “These have been comprehensive in helping inform our clients.” Topics have included consumer sentiment and COVID-19-related safety measures.

Along with Capozzoli’s new role, the company launched SAFER, RA’s safety and well-being platform in response to COVID-19. This initiative encompasses health and safety measures as well as communications geared to keeping everyone informed and confident.

“Every RA associate has to go through safety and hospitality Compassion programs,” says Cattani. “In addition, for every client, we’ve developed a reopening package that covers menus, staffing, training and support.”