As restaurants chart their path to recovery, many experts have predicted that digital platforms would play a critical role in the industry’s comeback efforts. And according to data from the NPD Group, these predictions are starting to prove true.

Digital orders grew by 106% in April compared to year ago and now account for 20% of all restaurant occasions, per NPD Group. “Among the most interesting behaviors we’re seeing is the rapid escalation of using technology to engage with restaurants,” says David Portalatin, NPD food industry advisor. “Going forward, we might expect a digital divide that sets apart restaurants with well-executed digital offerings and requires those without to turn to the newfound prowess of third-party platforms.”

Digital orders grew by 106% in April compared to year ago and now account for 20% of all restaurant occasions, per NPD Group. “Among the most interesting behaviors we’re seeing is the rapid escalation of using technology to engage with restaurants,” says David Portalatin, NPD food industry advisor. “Going forward, we might expect a digital divide that sets apart restaurants with well-executed digital offerings and requires those without to turn to the newfound prowess of third-party platforms.”

Of the myriad changes operators have made since shelter-in-place edicts have forced them to rethink their businesses, the technology-related updates are among those that seem to have the greatest staying power. In fact, 81% of operators that added new online ordering/prepay functions feel these initiatives are effective and will likely last once the pandemic is over, according to a May 27 Datassential study. Also, 79% of operators feel similarly about their decisions to sign on with third-party delivery providers.

As digital transactions have grown, overall industry performance has improved. For example, transactions at restaurant chains declined by 18% in the week ending May 24 compared to same week a year ago. This represents a 25-point gain from the steepest decline during the COVID-19 pandemic of -43% in the week ending April 12, according to NPD’s CREST Performance Alerts.

Full-service chain restaurant transactions declined by 42% compared to the same time one year ago, a 7-point improvement from the prior week’s decline of 49% from year ago, per NPD. Transactions at quick-service restaurant chains were down -17% in the week ending May 24 compared to the same week year ago, improving from the -20% decline in the prior week.

Total industry traffic at chain and independent restaurants was down -35% in April compared to a year ago. Drive-thru, primarily at quick service restaurants, accounted for 46% of all restaurant occasions, per NPD.

Naturally, as restaurant performance improves, so too, does operators’ outlook. For example, 31% of restaurant operators describe themselves as being cautiously optimistic their businesses will survive the COVID-19 pandemic, per a May 27 study from Datassential. This marks a 9% improvement compared to when Datassential posed the same question on April 3. In addition, 58% of operators are worried but fairly confident their business will survive, down 7% since April 3. And 11% of operators remain nervous their restaurant will not come back to business, down 2% since April 3.

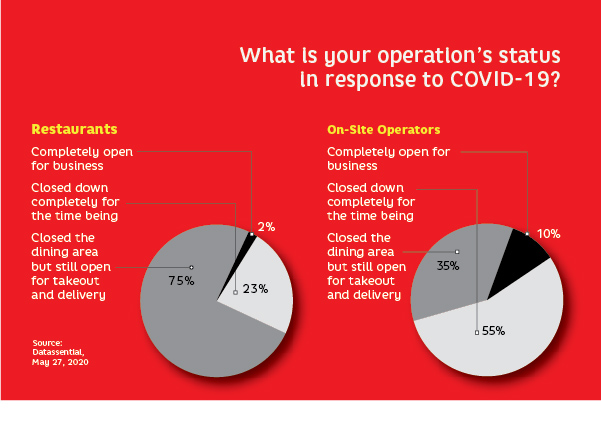

While many states continue to ease their coronavirus-related restrictions, it is important to note only 6% of operators are completely open for business, meaning their dining rooms are open and there are no COVID-19-related restrictions on them, per Datassential. In contrast, 28% of operators remain completely closed and 65% of operators say their dining rooms remain closed but their operations remain open for carryout and delivery. These numbers show the reentry process is only beginning for the industry. And it is not uncommon for operators to realize it is more difficult to reopen than it was to shut down their businesses.

As the shelter in place orders continue in some form across the country, 80% of operators report an increase in takeout sales, but not enough to offset dine-in sales, according to Datassential. It should come as no surprise that operators continue to tinker with their menus. In fact, 50% of operators have narrowed or limited their menus, 22% added family-style or bulk offerings and 21% added more comfort food offerings, per Datassential. Interestingly, 24% of operators say they have not made any changes to their menus, per Datassential. This represents a 10% decline since April 3.