It’s not news that the lines between various foodservice segments continue to blur. Yet when it comes to the demarcation between quick-service restaurants and c-stores, the numbers don’t lie: It’s getting harder and harder to see the actual lines.

Image courtesy of Caseys PizzaThe Sept. 10 announcement that c-store chain RaceTrac is set to acquire fast-casual sandwich chain Potbelly Corporation only further cements the connection between food and c-stores. The transaction is set to close in the fourth quarter of 2025 in an all-cash deal valued at $566 million.

Image courtesy of Caseys PizzaThe Sept. 10 announcement that c-store chain RaceTrac is set to acquire fast-casual sandwich chain Potbelly Corporation only further cements the connection between food and c-stores. The transaction is set to close in the fourth quarter of 2025 in an all-cash deal valued at $566 million.

RaceTrac operates roughly 800 c-stores; Potbelly has roughly 445 stores in the U.S. A statement announcing the deal noted the two companies have “complementary strengths as multi-unit, multi-market consumer facing businesses …”

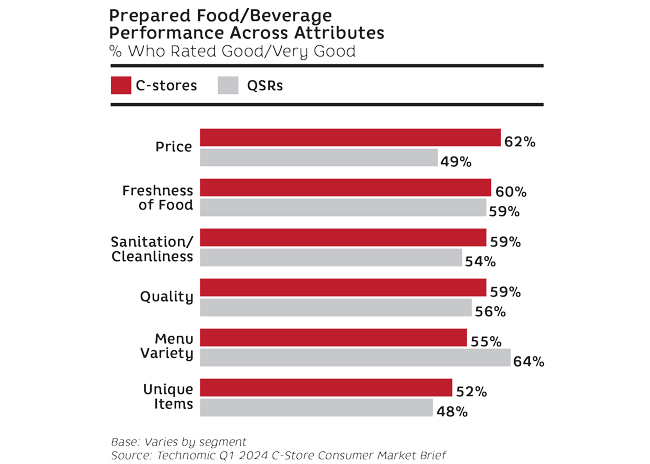

The RaceTrac/Potbelly deal will certainly bring a spotlight to foodservice strategies within the c-store segment and that sector’s growing commitment to food programs. Convenience store foodservice sales grew 5% in 2024, and projections call for another 5.7% gain in 2025, per Technomic. QSR sales rose 4.1% last year and are expected to rise 4.7% in 2025.

But it’s not just the sales results that show c-stores are now competing directly with QSRs. Consumers are saying it, too. In fact, 72% of the consumers polled for the 2025 Convenience Store Trends report from customer experience solutions firm Intouch Insight say they now see convenience stores as a real alternative to QSRs — a huge jump from the 56% who said the same when surveyed for the firm’s last trends report just one year ago.

While 43% of consumers in the 2025 study say c-store food is just as fresh as that offered by either QSRs or grocery stores, 11% believe prepared foods from convenience stores are better than those of either competing segment.

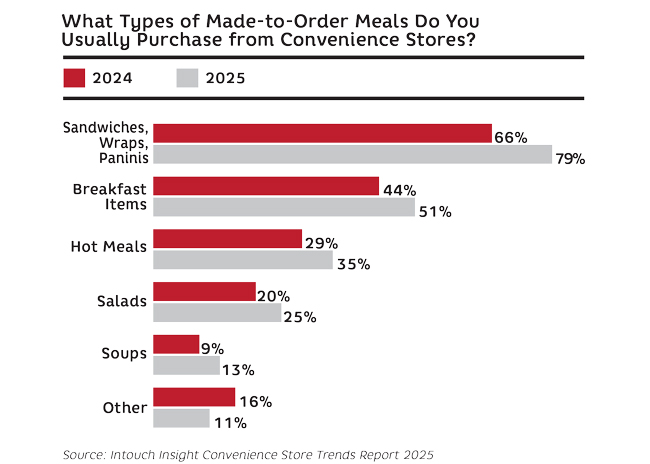

Respondents’ reported usage of c-store foodservice has risen: 79% frequently purchase made-to-order sandwiches, wraps or paninis, up 13 points from last year, and 51% are in the habit of stopping at c-stores for breakfast items, up seven points from 2024, per the Intouch Insight data. While breakfast and lunch sandwiches remain the most-purchased foodservice item, hot meal purchases rose from 29% of foodservice transactions in 2024 to 35% in 2025, while salads climbed from 20% to 25%.

What’s driving foodservice growth at c-stores?

“Convenience stores are in an interesting competitive position these days because consumers are very price-conscious and deal-seeking,” says Donna Hood Crecca, senior principal at Technomic and author of its 2024 Convenience-Store Foodservice Outlook report.

“C-stores can grow foodservice sales in two ways,” Crecca says. “One is by increasing the frequency of current customers, which they’re doing with promotions, LTOs and loyalty rewards programs. The other way is to steal share from QSRs. They’re in a good position to do that, because consumers have price fatigue with fast food, and c-stores often offer comparable items at lower prices. But to steal share, c-stores have to deliver food and transaction experiences similar to what consumers would get from a QSR. There’s an ambition among c-stores to compete; at some chains, the foodservice area is very much a QSR experience.”

Who’s Doing What and How

C-store chains considered leaders in foodservice tend to have a specialty, Crecca says. “C-store operators understand that they have to be known for something.”

As examples of this she points to Sheetz and Wawa, two Pennsylvania-based chains that operate primarily in Mid-Atlantic and eastern Great Lakes states. For both, the core program consists of made-to-order breakfast and lunch sandwiches plus made-to-order beverages. Patrons can use kiosks to customize their orders. Both chains also offer other QSR-like amenities, including free Wi-Fi and in-store seating. Those features “make c-stores feel more restaurant-like,” Crecca says, “but the stores are also offering packaged beverages, candy and household items, giving them a competitive edge over QSRs.”

Among the sandwich specialists, there are subniches. Wawa has the hoagie sandwich “that’s been part of its DNA forever,” Crecca says. Another Pennsylvania-based chain, GetGo, which was purchased in July by Alimentation Couche-Tard (also parent company of Circle K), has “very distinct sandwich offerings,” she notes.

Another menu niche gaining notice on convenience store menus is chicken. Crecca calls out Parker’s Kitchen, whose hand-breaded chicken is fried in its South Carolina and Georgia stores and sold both in sandwiches and as part of family meal buckets.

Beating QSRs at the Pizza Game

Pizza is the first thing many people think of when they picture Iowa-based Casey’s. “Obviously, pizza is their calling card,” Crecca says. The c-store chain reports it’s the fifth-largest pizza restaurant in the United States, selling more than 45 million pizzas yearly. It got there by siting stores in rural areas with little chain or independent restaurant competition in pizza, and gradually developing its real-pizza-shop reputation by word of mouth.

“This isn’t gas station pizza. It’s restaurant-quality food from a gas station,” says Brad Haga, Casey’s senior vice president, prepared food and dispensed beverage. “Casey’s is known for our pizza featuring our made-from-scratch dough, 100% real mozzarella cheese, fresh veggies and quality meats, all handmade in real kitchens in each of our stores.”

Haga says Casey’s continues to grow its pizza business along with other foodservice. “We deliver craveable options and consistent quality, collaborate with our partners on unique ‘only at Casey’s’ products and use our proprietary guest insights process to help us discover, validate and optimize new food and beverage concepts and products faster to meet evolving consumer preferences,” he says. Each day, the chain also makes all prepared foods, from breakfast items and hot sandwiches to sauced chicken wings and pizza, fresh in-store. And that’s not likely to change any time soon. “We’re always looking for new equipment that can increase kitchen efficiencies while ensuring we maintain consistent high-quality products,” Haga says.

Crecca also notes that “7-Eleven is leaning in on pizza baked in its units, both whole pies and slices.”

Would You Like a Drink with That?

7-Eleven has its own portfolio of company-owned chains, including Laredo Taco Company. Products in this Mexican combo sport both Loredo Taco branding and 7-Eleven’s Big Gulp beverage branding. Photos courtesy of 7-ElevenIf there’s one product 7-Eleven is known for, it’s the sweet, slushy Slurpee, which it has offered since 1965. The chain regularly updates the iconic beverage with seasonal and limited-time flavors, for example its Mountain Dew Infinite Swirl Slurpee drink.

7-Eleven has its own portfolio of company-owned chains, including Laredo Taco Company. Products in this Mexican combo sport both Loredo Taco branding and 7-Eleven’s Big Gulp beverage branding. Photos courtesy of 7-ElevenIf there’s one product 7-Eleven is known for, it’s the sweet, slushy Slurpee, which it has offered since 1965. The chain regularly updates the iconic beverage with seasonal and limited-time flavors, for example its Mountain Dew Infinite Swirl Slurpee drink.

Casey’s prioritizes innovation in flavor and variety with the drinks on its menu. A new Frost Berry Freeze flavor of the C4 energy drink, exclusive to Casey’s, rolled out in summer 2025. In late 2024, the chain launched a new Darn Good Coffee program featuring a wider selection of roasts, caffeine levels and flavor profiles.

“Coffee is hot, whether it’s hot or cold,” says Crecca. “Over the past two years, many c-stores have moved to bean-to-cup coffee systems. The machine literally grinds the beans and then dispenses a cup of coffee made to order. Circle K, GetGo, Wawa and Sheetz all have them.” Most of these stores also dedicate space to a more traditional coffee dispensing system for customers unwilling to spend extra time and/or money for the premium products, she adds.

“Then there are those who are all in on cold brew coffee, including Sheetz, Wawa and QuickChek,” Crecca says. “These cold coffee offerings, often made to order, rival what we’re seeing in restaurants.” The cold coffees frequently feature seasonal flavors, like QuickChek’s autumnal Pumpkin Spice.

Arlene Spiegel, president of Arlene Spiegel & Associates, points out that coffee programs are a hot opportunity for c-stores to partner with local roasters or grocers for a branded or private-label program.

A new coffee program can lead to a lot of other rethinking, Spiegel says: “The design of stores is changing based on what’s convenient for customers. They’re mostly ordering ahead by app and picking up their coffee at the counter or going through the drive-thru, but there should be kiosks in the store for those who didn’t order ahead. Since the coffee pickup is now close to the point of service, there’s an obvious adjacency opportunity to offer specialty baked goods. Those sensual aromas rising from the coffee-and-baked goods area are part of customer experience engineering, which means investing in quality air control. And why not have a hot soup and sandwich area? And it would be great if a coffee drinker who bought lunch could also come back tomorrow based on a digital breakfast bounce-back incentive.”

A number of convenience store chains are increasing their emphasis on branded foodservice, foremost among them 7-Eleven. The chain counts Laredo Taco Company, which sells handmade tacos and Mexican street food, and Raise the Roof, which sells made-from-scratch fried chicken and proprietary sauces, among its branded foodservice concepts.

Higher Tech

Technology in convenience stores is evolving quickly. At Casey’s, “We’re upgrading the technology that allows our guests to enjoy the food they love in new and convenient ways,” reports Brad Haga, Casey’s senior vice president, prepared food and dispensed beverage. “We implemented an AI-driven, automated voice assistant to our entire footprint to help execute off-premises orders. It answers incoming phone calls, processes new orders, offers reorders, and its upselling options now account for nearly 10% of food orders. We’ve built processes and standards that mirror those of QSR competitors, allowing us to deliver restaurant-quality food in a fast, accessible format.”

7-Eleven, like almost all convenience store chains today, allows patrons to preorder their coffee via a mobile app, but also offers product selection screens in stores.

7-Eleven, like almost all convenience store chains today, allows patrons to preorder their coffee via a mobile app, but also offers product selection screens in stores.

Equipment: Form Follows Function

C-store operators’ options in cooking and holding equipment are also changing, with their choices driven by several considerations — above all, how much food they cook and how much they source from outside.

Although 7-Eleven partners with Warabeya North America and other commissaries to supply some fresh foods including grab-and-go sandwiches and salads, it’s also focusing more on in-store food production, including installing new ovens in units for baking cookies and pastries. The ubiquitous roller grills, employed for items ranging from taquitos to hot dogs, have also been upgraded. The chain's food and beverage modernization, including modernized bake-in-store programs and grab-and-go cases, is expected to continue. In 2024, 7-Eleven announced that it would build 500 “New Standard” stores with a greater focus on fresh food, a more personalized customer experience, kiosk ordering, mobile checkout, more in-store seating, and integration with third-party delivery services.

Almost all operators offer some balance of in-house and commissary-sourced food items, says Technomic’s Crecca: “If they have a made-to-order sandwich program, they’ll also have sandwiches ready to go in a cold case. We’re working on research for a new Technomic c-store food study, and we see increased incidence of made-to-order foods, along with a lot of investment in hot cases as well as equipment upgrades to increase capacity and support the menu. So our understanding is that operators are elevating cooked-in-house menu items that will be available to customers in the hot case.”

Operators seek hot merchandisers that keep food moist and at appropriate temperatures, and attractive state-of-the-art hot and cold cases that sport the store’s brand and “make the food pop,” says Crecca. “Operators struggle with menu optimization, and they want to have the right assortment within the hot case — all the chicken items or all the breakfast sandwiches. And the cold cases are for customers who want to take items home and reheat them.”

In addition to these workhorse merchandisers, Crecca says c-store operators want “fun, portable hot cases with clearly visible easy-to-eat snacks, from kolache to french fries to onion rings.”

A chain’s labor model will influence its store design and equipment package. “Not all c-stores have dedicated foodservice staff. Workers are multitasking, so equipment needs to be both simple and smart — easy to use as well as alerting staff on food cook times, removal times and holding times,” Spiegel says.

Advances in equipment technology can allow c-store operators to rethink their needs. Spiegel says new electric equipment has expanded options for c-stores. “There’s almost nothing you can’t do now with electric equipment including ventless items,” she says. “There’s a wealth of custom and off-the-shelf plug-and-play equipment that’s perfect for retail. I’m a big fan of small multitasking equipment.”

Space dedicated to equipment means less space for customers to queue up at the counter or sit down to eat and talk to each other. So Spiegel likes refrigeration companies that “do custom reach-ins with glass doors, in all types of configurations that can fit into a store.” Her philosophy on the ideal c-store kitchen battery: “Best-in-class equipment and low product inventory make for very little waste.”

And no matter how sophisticated equipment and technology become, Spiegel says there’s something that should never change. “Let’s not take hospitality out of the equation,” she reminds operators. “Customers still like to be recognized with a ‘good morning,’ ‘thank you’ or ‘good to see you again.’”