Our subscribing operators offer their take on the issues that impact purchasing decisions, from economic factors to qualities they look for in suppliers and much more.

The purchasing of foodservice equipment and supplies represents an aspect of a foodservice operator's business that consumers don't ever seem to notice. And yet equipment and supplies purchases represent an area that if not managed effectively and efficiently can have a profound impact on the culinary staff's ability to deliver on the concept's brand promise. Simply put, proper management of equipment and supplies purchases equips culinary staff with the tools they need, allowing them to focus their energies on where they can have the greatest impact: serving customers.

In this study, FE&S asked its operator readers to share their most pressing business concerns, outline where they purchase their equipment and supplies and describe their expectations for their supply chain partners. Over the course of this study, we learned that while product price and quality are of the utmost importance to operators, they do place an extremely high value on their supply chain relationships. And while operators feel they interact with their supply chain partners regularly enough, there are still areas where dealers and other distributors can enhance their service levels.

This study also showcases some of the profound differences in the way commercial and non-commercial operators view their businesses and how that affects their approach to procuring foodservice equipment and supplies. And, naturally, a study today would not be complete without a quick look at social media.

Over the next few pages we will explore these topics and others in greater detail with the hopes of allowing operators to benchmark themselves against their peers and provide the individual members of the supply chain with a few ideas about how they can strengthen their customer relationships.

Operating Pressures

Making an already challenging business climate even trickier to navigate are a number of foodservice-specific factors including increasing food costs, food safety concerns, increasing energy and labor costs, and finding and hiring qualified employees. As a result of these factors, a majority of foodservice operators have altered their approach to purchasing food, foodservice equipment and even supplies. In fact, only 28 percent of foodservice operators report not having to adjust their purchasing strategies as a result of these business challenges.

Generally, both commercial and non-commercial operators' primary responses to these challenges are similar, namely reducing inventory levels and using more rebates and coupons. Commercial operators showed a stronger likelihood to buy items on special, while their non-commercial counterparts turned to more private label items to weather the economic tide.

When it comes to equipment purchases both operator segments have responded by requiring more bids than before, repairing rather than replacing existing equipment and are even delaying new purchases. It is also interesting to note that commercial operators are roughly four to five times more likely to purchase used equipment than non-commercial operators.

The study also showed that 42 percent of commercial operators report buying more equipment directly from manufacturers, compared to only 15 percent of non-commercial operators. In contrast, 34 percent of non-commercial operators indicate they are channeling more of their purchases through buying groups or group purchasing organizations, compared to 17 percent of commercial operators. This is probably why non-commercial operators are more likely to have a contract for their foodservice equipment and supplies purchases when compared to commercial operators.

Among the operators that have contracts for their foodservice equipment and supplies purchases the most common product categories include disposables/paper goods, janitorial and sanitation products, warewashing and safety products, smallwares and primary cooking equipment. The vast majority of these contracts — 71 percent — last two years or less.

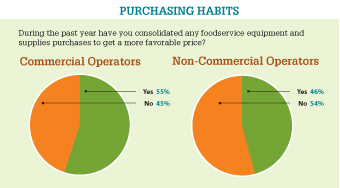

Roughly half of foodservice operators have consolidated their purchases to get more favorable pricing, with this trend being slightly more prevalent in the commercial segment.

Exactly which purchases are likely to be consolidated differs a little between the two operator segments, though. Both segments list smallwares and disposables/paper goods as the two most popular areas for consolidating their purchases. But when it comes to the consolidation of janitorial and sanitation products, 52 percent of commercial operators follow this path compared to only 35 percent of non-commercial operators. This is probably due, in part, to the fact that some non-commercial operators purchase their janitorial and sanitation supplies through departments other than foodservice.

Supply Chain Matters

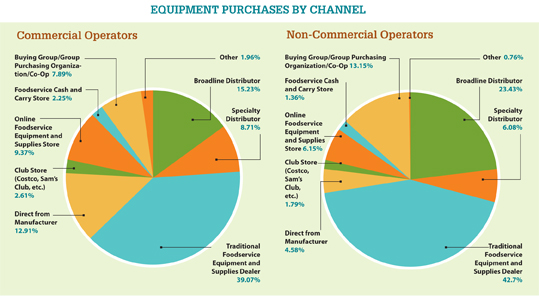

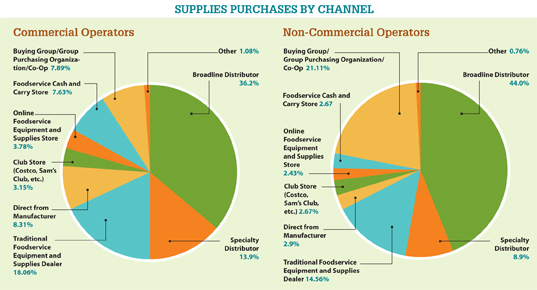

Traditional dealers are viewed as the primary and broadline distributors secondary options when it comes time for both operator segments to purchase foodservice equipment and supplies. But it is in the next set of options where they start to divert. For example, commercial operators cite purchasing directly from the manufacturer as their third option while online equipment and supplies stores and specialty distributors tie as their fourth option. In contrast, non-commercial operators list buying groups/group purchasing organizations as their third option and specialty distributors as their fourth option.

When deciding who to buy from each group generally expects the same primary attributes — competitive pricing, quality products and excellent product knowledge — from vendors. In terms of secondary traits, their expectations are generally similar, too. Both segments value having a good relationship with their sales reps and place value on the vendor's ability to quickly remedy problems or correct mistakes, making ordering easy and delivering their products on time. Also, both segments seem to show a preference toward working with vendors that have a local presence in their markets.

The good news is that despite the uneven nature of the business climate these days, supply chain relationships seem to remain on relatively solid footing. In fact, 85 percent of the operators participating in FE&S' purchasing study said they have not switched foodservice equipment and supplies vendors in the past 12 months. Not surprising, though, is the fact that among those who did make a switch, pricing was the primary factor. The other key factors contributing to the switch include better customer service, on-time delivery and the vendor's ability to show a better understanding of the operator's business.

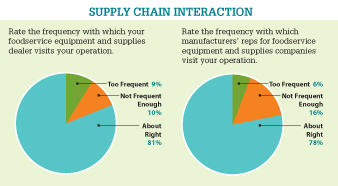

In addition, operators generally feel they see their dealer sales reps regularly enough. Still, that does not mean that dealers don't have the opportunity to fortify their customer relationships. When citing ways dealers and other members of the supply chain can improve their service, 34 percent of operators felt their vendors could better understand their customers' business. And 26 percent of the operators surveyed would like a more timely response when they contact their reps and for their vendors to offer online ordering.

With respect to actually placing orders for foodservice equipment and supplies, operators employ a variety of solutions, with the most popular being online ordering systems, calling in orders over the phone and having a sales rep manage the ordering process.

Researching Equipment Purchases

When purchasing foodservice equipment, 75 percent of operators rely on their own research first, followed by a recommendation from their dealer to help select the right product. In terms of secondary factors, it was interesting to note that both segments rely on recommendations from their peers, which could indicate a significant level of trust in their colleagues' experience and perspective. Also, non-commercial operators seem to refer more frequently to information that comes directly from manufacturers than commercial operators. This is likely due to the fact that non-commercial operators generally need additional levels of buy-in to gain approval for foodservice equipment purchases and look to the factories to help provide more detailed informaiton.

Despite the fact that a growing number of dealers now have test kitchens and some factories are even willing to lend an operator a piece of equipment to see how it fits within their operation, 48 percent of participating operators said they typically do not test a piece of equipment before purchasing it.

Due to the challenging business environment, many dealers report a growing amount of used foodservice equipment coming on the market. And of their 2011 foodservice equipment purchases, operators anticipate 12 percent will be of used items, up from 9 percent in 2010.

Due to the challenging business environment, many dealers report a growing amount of used foodservice equipment coming on the market. And of their 2011 foodservice equipment purchases, operators anticipate 12 percent will be of used items, up from 9 percent in 2010.

When looking for information about products, the top five resource options for foodservice operators from both segments are: manufacturer websites, foodservice trade publications, trade shows, trade publication websites and word of mouth recommendations from their peers. Other key sources of product information include vendor/supplier websites, printed directories and ads in foodservice trade publications.