As one reads the trade press and listens to restaurant industry pundits, the most common theme discussed over the past few years has been the call for restaurants to implement more and better technology into their operations.

This is true for chains, independents, and even noncommercial operators such as colleges and healthcare foodservice operators. Unfortunately, the discussion often translates into “because delivery is growing in importance to consumers, operators should hop on the delivery bandwagon as soon as possible.” This discussion has merit because from a consumer perspective, if a restaurant does not provide delivery, it often drops toward the bottom of the consideration set — if it is not rejected completely. Unfortunately, technology beyond the basic requirements to participate in the delivery process rarely get mentioned.

Yet, technology supplies a spectrum of potential enhancements much broader than delivery. In the current business environment, operators should consider a variety of other types of technology, all of which have the potential to grow an operator’s customer base and/or enhance profits. To not seriously consider implementing some sort of technological upgrade is to increase the likelihood that a business will fall behind in their customers’ choice set — and ultimately close their doors as sales move elsewhere.

The key question becomes what technology should operators evaluate? Start by prioritizing the evaluation of any technology that enhances the customer experience. How can operators make their customer interactions more seamless? Second, consider technology that can improve margin and operations. Operators often choose to implement both types of technology simultaneously because they are interconnected. In other words, companies that incorporate enhancements that make for better customer purchase or eating experiences typically need to enhance systems that support those efforts. This can include not only software but other design and equipment elements.

While it may offer plenty of promise, it must also be emphatically stated that technology is not a replacement for staff. Instead, technology provides the opportunity to reallocate labor to areas that will speed operations and get food out the door more quickly, improving the customer experience.

Where to Start

Any number of perceived and real barriers pop up when implementing new technologies. Here are the top three factors impeding restaurants from making technology-related investments, per the 2018 Dining Experience Study conducted by Incisiv BRP-Windstream:

1. Operator does not have enough resources: Lack of budget is the number one challenge impeding operators’ ability to invest in upgrading the customer experience. One third of operators also rate the lack of skilled IT resources as a challenge.

2. Operator can’t justify the return on investment: The inability to build and justify the business case for investment is a significant challenge impeding potential spending.

3. Operator doesn’t have an integrated strategy: Close to one third of operators cite the absence of an integrated guest experience strategy and lack of management buy-in as a top challenge.

Company leaders must create a business case that utilizes existing budgets to move forward on this important decision. Again, the key driver in the decision-making process is what type of technology will provide the most positive impact on the business based on the current and future budget.

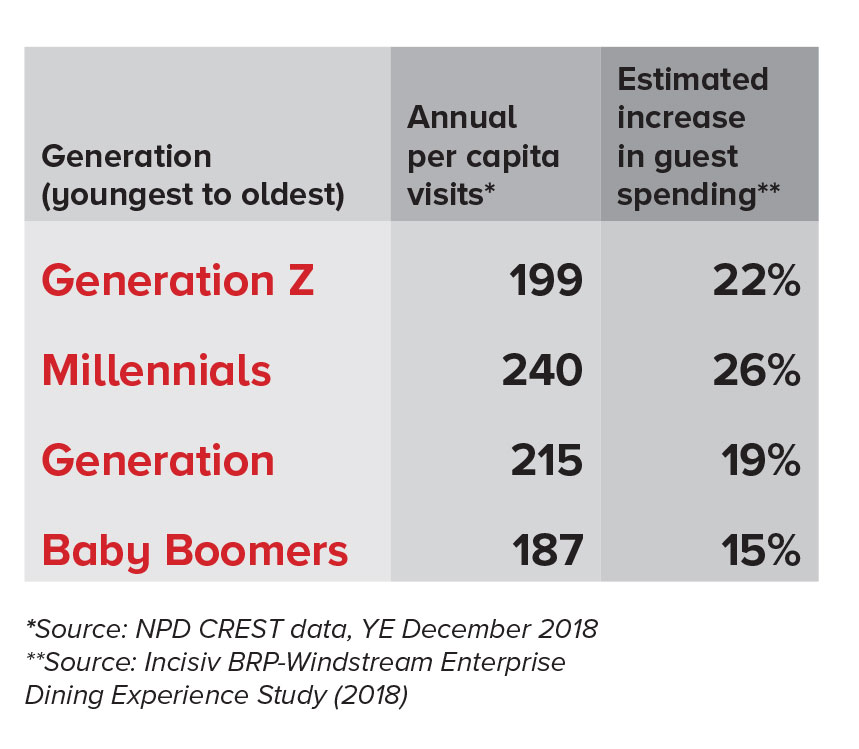

Let’s assume that due to smart planning, a budget exists for some enhancements. Where to start? An appropriate starting point is to segment existing customers based on usage and age as these metrics are interrelated. Why? Because any technology under consideration must have a positive impact on as broad a base of customers as possible. Recall that younger demographic groups make more per capita visits to restaurants than do older customer groups. As such, technology that appeals to younger customers can provide a bigger bang for the buck if implemented correctly.

The data suggests that if a restaurant caters to an older clientele that the investment in technology will likely achieve a better ROI if the investment is made in back-of-the-house operations rather than the front-of-the-house experience or digital access. Studies have shown that older restaurant users are much more likely to prefer human interaction than younger customers who have a lifetime of experience with cell phones and mobile apps.

The data suggests that if a restaurant caters to an older clientele that the investment in technology will likely achieve a better ROI if the investment is made in back-of-the-house operations rather than the front-of-the-house experience or digital access. Studies have shown that older restaurant users are much more likely to prefer human interaction than younger customers who have a lifetime of experience with cell phones and mobile apps.

Said another way, improvements to service, lighting and front-of-the-house ambience still have a greater impact on older customers. Driving incremental sales with digital technology among older customers is less likely.

Conversely, Gen Z and Millennials feel much more comfortable using digital means to order and pay for food, regardless of how they order or where they eat the food. Younger demographic groups eat a much smaller percentage of restaurant meals on premises, while taking greater advantage of takeout and delivery. This means the actual ordering process has to be as easy as ordering from Amazon — a minimum of clicks on a computer or personal device to order and pay for any meal.

For operators that focus on appealing to more frequent restaurant users, data collected for The NPD Group’s Digital Evolution of Foodservice study shows the top three tech-related features that lead to choosing a specific restaurant are websites, smartphone apps and smartphone payment services. These factors rank the highest among visitors across all outlets. And this means that ongoing maintenance and enhancements of websites and phone apps is a need to have, not a nice to have.

The Basics: Understanding an Operation’s Current Digital Capabilities

Most operators that plan to build and retain their customer bases need to meet some basic table stakes. What are the technologies that guests expect an operator to have in 2020? According to data from the Incisiv BRP-Windstream Enterprise Dining Experience Study, guests expect operators to have some, if not all, of the following: complementary customer Wi-Fi, contactless and/or mobile payment, digital receipts and mobile text alerts for order status.

In addition, many savvy operators offer in-restaurant interactive kiosks to not only enhance speed of getting food into customers’ hands but also to increase potential upselling, speed ordering/payment and provide opportunities for customization. Tech-savvy operators also utilize geofencing to offer location information and targeted promotional offerings to draw customers to a location, adding to an operator’s competitive advantage and helping enhance effective and efficient use of resources.

All of the above require adequate network bandwidth to handle higher use during peak traffic periods. Ensuring you have the appropriate network bandwidth to cover customer use, front-of-the-house technology and back-of-the-house operations is the minimum expenditure every operator need consider.

Current State of Delivery

As stated above, much of the focus on technology in the recent past has been on delivery. More operators offer delivery than ever before, regardless of the economics associated with this service mode. Though delivery has grown at double-digit rates over the past five years, delivery still only accounts for

5 percent to 8 percent of all restaurant use occasions. Over the same period, visits to restaurants in total have declined slightly. This indicates that delivery is not necessarily providing incremental visits to restaurants; instead, delivery is taking the place of more traditional restaurant usage occasions. Despite all the hype, delivery is not the panacea the industry was expecting. Regardless of current forecasts of continued double-digit growth for delivery, the outlook for growth in industry visits remain dim.

Notwithstanding the many improvements made throughout the delivery process, offering this service to consumers still demands financial resources to install the appropriate technology and the staff to support these efforts.

For example, will the operation be able to use its own employees to deliver food orders, or will a third-party provider be necessary? Both options have certain advantages. If an operator manages its own delivery team, the company does not share 20 percent to 35 percent of each order with its delivery providers. This savings can help to fund an in-house delivery team. Having control over the delivery team also enables an operator to better control the delivery process from start to finish. This includes such areas as how the team represents the concept, the way delivery team members handle the food they deliver, and the way incomplete or incorrect orders are dealt with.

More often than not, operators still take the blame for issues with delivery, regardless of whether their employees or a third-party provider cover the last mile. The likelihood of repeat ordering from an operator after a bad delivery experience diminishes quickly. Given the plethora of options available to them, consumers won’t continue to order from an operator after less-than-satisfactory experiences.

Domino’s has a reputation for offering one of the best delivery experiences in the industry. Not coincidently, Domino’s annual same-store sales increases have been outstanding over the past 10 years. The company built its reputation by continually upgrading components of the delivery service to make it more customer friendly. Most recently, Domino’s unveiled plans to add GPS delivery tracking technology to its U.S. stores. Customers who order from stores that have this capability can follow their order and delivery driver on an interactive map after the order is completed. Customers receive an estimated delivery time and can opt into text notifications that let them know when the order is on its way, when it is about two minutes away and when it has arrived.

We have all seen the TV commercials that show how Domino’s will fix an incorrect or incomplete order by expediting a new delivery to a customer’s location. Third-party delivery services cannot provide these services. The reason for this approach is to help maintain loyalty to the Domino’s brand in a way no competitor can match.

Though customers do not expect every delivery experience to match that of Domino’s, the bar continues to be raised. The speed of delivery online retailers provide continues to set the expectations for American consumers. Consumer preferences are shifting to those operators who will deliver (hot) food the most quickly.

If an operator commits to offering delivery, they must also take into account a variety of back-of-the-house considerations. Do delivery orders interfere with on-premises meal preparation, especially at peak hours? Is it possible to create a separate production space for delivery and takeout orders that will ensure that food is ready to go when the delivery team is ready to head out the door? This is especially true when an operator works with multiple third-party delivery services. Operators must dedicate space to suppliers’ order screens and to hold orders ready for pickup or delivery.

For many operators, delivery requires a separate entrance for drivers. Others may develop separate holding areas away from the customer ordering space to ensure delivery staff do not interfere with customers at the host stand or those in line waiting to order.

Finally, if delivery is offered using third-party services, operators should utilize technology that ties orders communicated via each service’s captive order screens into their POS system. Without this technology, food preparation times and inventory control can become very problematic. Service providers that enable POS integration exist, but their service is not free. Typically, these providers collect a fee for development and installation, and then they receive a nominal fee per order processed into the POS. Importantly, several suppliers also enable operators to identify and track individual customers, creating the ability to determine customer value over time and the opportunity for targeting more personalized offers.

Bottom line: If operators choose to provide delivery or pickup from their restaurants, they need to be all in. An operator can no longer be competitive providing delivery or customer pickup simply by answering a phone and taking an order. Your customers have much higher expectations for order accuracy, ease of payment and speed of delivery. When making an investment, be sure to cover all the necessary costs to provide a seamless transaction from start to finish.

Are Kiosks Part of the Solution?

The rising cost of labor often serves as an incentive for considering kiosks as a technology upgrade. Kiosks have the ability to offer many services that will increase customer satisfaction and increase sales per customer, but they do not serve as a substitute for staff.

As mentioned earlier, take the customer base into consideration when installing kiosks. According to a survey by the National Restaurant Association, 38 percent of Millennials have already ordered food via a kiosk versus 18 percent of Baby Boomers. Major food chains including Panera, Wendy’s, Chipotle, Burger King and McDonald’s all incorporate kiosks into their newer stores.

Kiosks are most likely to be used by younger customer groups because they are more comfortable customizing their order electronically, not simply selecting preset options. This, in turn, expands the menu without expanding inventory for this key buyer group. Order accuracy will also improve on customized orders because all the requested components will be provided in a clear, easy-to-understand manner to back-of-the-house staff.

Kiosks also provide the opportunity to speed the entire ordering process. Long lines in restaurants are viewed as barriers to purchase. Think about the lines that form in a restaurant’s lobby area at breakfast and lunch, when customers have limited time to wait. How many people walk in the door and walk right back out because lines and wait times are too long?

If the line at a counter is more than four people long, customers would prefer to order from a kiosk, according to a study by Tillster. That said, operators should assume installing self-order kiosks will require an increase in back-of-the-house staff to keep up with the faster order input and expected faster food preparation time. If a customer saves time in the ordering process, waiting longer to get their food defeats the benefit of kiosk use. The customer expectation is that using a kiosk will shorten the time to order and receive food.

Based on the success of self-order kiosks, some operators have decided to move closer to an all-digital front-of-the-house ordering system. A Moe’s Southwest Grill franchisee plans to open an all-digital unit in the Pittsburgh suburb of Oakland. “All-digital, meaning you order and pay for your food on an app or at a kiosk,” said Mike Geiger, who owns eight Moe’s in this region with his partner. “With the age of the audience and the desire of less interaction and quicker service of that audience, we want to meet what our customers want.”

Others see results that are equally as impressive. Wendy’s Chief Information Officer David Trimm told the Columbus Dispatch that a $15,000 investment in deploying a trio of kiosks in a restaurant would see a payback in less than two years. According to one kiosk developer, restaurants with self-order kiosks typically see an average increase between 15 percent and 35 percent per check. This figure is supported by a survey conducted by Networld Media Group where respondents reported average ticket lift of 20 percent to 30 percent and higher productivity from staff when kiosk technology was deployed.

One additional benefit of self-order kiosks — and digital menu boards, for that matter — is the ability to help operators comply with menu labeling laws, which went into effect in May 2017. These regulations, set by the U.S. Food and Drug Administration, require all restaurants and food chains of 20 or more locations to post nutrition labels for all standard menu items. Rather than updating static posters and paper-based menus, information can be updated on kiosks — in any location around the world — from one centralized location at the touch of a button.

Customer Payment Options

An October 2016 report from New York-based research firm Accenture indicated the percentage of North American consumers who use cash at least weekly to make purchases fell to 60 percent, down 7 percentage points from the same period year over year. In findings delivered by the TSYS 2016 U.S. Consumer Payment Study, only 5 percent of those surveyed between the ages of 25 and 34 use cash. Clearly, younger generations are much more comfortable paying for goods and services electronically.

Yet, a sizable segment of the U.S. population makes the vast majority of restaurant purchases with cash. If an operator decides to move to all-electronic payments, it may miss out on upward of 25 percent to 30 percent of sales. The percentage of cash sales in upscale restaurants is lower, so the issue of cash payment ties much more closely to quick-service outlets.

Finally, a growing number of municipalities (including Philadelphia and New Jersey) are passing laws banning cashless stores. For the foreseeable future, restaurants will have to continue accepting all forms of payment in order to maximize sales. As mobile ordering continues to gain traction, cash will lessen in importance. This will, however, push operators to upgrade their mobile payment capabilities to ensure fast and safe transfer of credit and debit card information.

The Bottom Line

The good news for restaurant operators is that technology that enables a better customer experience is becoming more accessible and affordable. The bad news is that it’s more likely that your competition is improving its capabilities because it has become more affordable. Consideration of technology improvements in 2020 and beyond is no longer a “maybe” opportunity. It has become a must-do exercise as your customers see little reason why they cannot order food from a restaurant with the same ease and speed as they order goods on Amazon. Customer expectations continue to rise, and no restaurant can afford to fall behind.

Off-Premises Consumption Stats

More than half — 60 percent — of all restaurant occasions result in off-premises consumption of food, according to statistics from the National Restaurant Association.

- 92 percent of customers used drive-thru at least once per month.

- 79 percent used restaurant delivery at least once per month.

- 78 percent of operators considered off-premises programs strategic priorities.

- 53 percent used a third-party app for delivery.

- 34 percent used delivery more than they did the previous year.

Source: Joint study by NRA and Technomic, October 2019

Warren Solocheck digs into technology applications in the second installment of FE&S’ 2020 Vision series. Solocheck offers his insights as an independent foodservice industry consultant with nearly 40 years of industry analysis experience.